Deepdive

(Advertisement)

Market Psychology: How Emotions Drive Crypto Cycles

Learn how emotions drive crypto market cycles. Understand fear, greed patterns and trading psychology to make better investment decisions in volatile markets.

Crypto Rich

March 13, 2021

(Advertisement)

Table of Contents

Last revision: September 26, 2025

Market psychology is the study of how human emotions influence price movements in financial markets. Fear and greed drive most trading decisions, creating predictable patterns that repeat across all market cycles. Understanding these emotional patterns enables traders to make more informed decisions during periods of volatility.

Every crypto trader knows the feeling. Excitement surges when prices rocket upward. Dread creeps in when portfolios crash overnight. However, what matters is that these emotions don't remain confined to individual traders. When thousands of people share the same sentiment simultaneously, their collective emotions can actually move entire markets.

What Is Market Psychology in Crypto Trading?

Market psychology examines how emotions affect trading decisions across entire markets. The mechanics are straightforward: when most traders feel optimistic, prices typically rise. When fear dominates, prices usually fall.

But crypto markets take this emotional drama to extremes. They trade 24/7 without breaks, unlike stock markets that close overnight and give emotions time to cool. This constant action means feelings can build up quickly and spiral out of control.

Crypto also attracts newer traders who haven't learned to separate emotions from strategy. A single news event can trigger massive price swings. What might cause a 2% move in stocks can easily create 20% swings in Bitcoin or Ethereum.

How Do Bull Market Emotions Develop?

Bull markets follow a predictable emotional pattern that plays out over months or years. The cycle starts quietly and builds to a dramatic peak before reversing. This progression happens in three distinct phases that traders can learn to recognize.

Early Stage Optimism

Bull markets begin when smart money starts buying during periods of widespread pessimism. Most people still feel nervous about the market, but a small group recognizes undervalued opportunities. Media coverage remains negative and participation stays limited.

This phase can last for months. Prices rise slowly while most traders remain skeptical. Only experienced investors and institutions participate actively. Online discussions stay mostly negative or absent.

Growing Excitement

As prices continue rising, more people notice the trend. Media coverage shifts from negative to neutral, then positive. New participants enter the market, increasing activity. Online discussions become more frequent and optimistic.

Fear of missing out (FOMO) starts affecting decision-making. People see others making profits and want to participate. This emotional shift drives more buying pressure, which pushes prices higher and attracts even more participants.

Peak Euphoria

The final stage of a bull market features extreme optimism and irrational behavior. Everyone seems to be making money easily. Risk management is often overlooked as traders pursue quick profits. Online discussions are filled with success stories and unrealistic price predictions.

Trading reaches a fever pitch. Participants flood the market daily, while prices make aggressive upward moves. Traditional media covers crypto extensively, often with overly optimistic stories. This widespread euphoria typically marks the market peak.

What Emotions Drive Bear Markets?

Bear markets trigger different emotions that unfold in their own predictable sequence. These feelings develop over time as prices decline and optimism fades. The bear market emotional cycle also has three main phases.

Denial Phase

Bear markets start with denial among investors who got caught near the peak. They refuse to accept that the bull run has ended. Every small price bounce gets interpreted as the start of a new rally.

Traders continue buying during price dips, expecting quick recoveries. Online posts still show optimism mixed with frustration. Many increase their positions, believing they're getting bargains.

Growing Fear

As losses mount and prices continue to fall, denial gives way to genuine fear. Panic selling begins as traders rush to limit their losses. Online sentiment turns negative, filled with regret and anger.

Trading volumes surge as people scramble to exit positions. Media coverage becomes increasingly negative. Many leave the market entirely, vowing never to return.

Capitulation Bottom

The final stage of a bear market brings complete emotional exhaustion. Even the most stubborn holders finally give up and sell their remaining positions. This mass selling often creates the actual price bottom.

Volume explodes during these capitulation periods. Online discussions are filled with stories of significant losses and warnings to avoid crypto entirely. This extreme negative sentiment typically indicates that the bear market is nearing its end.

Why Does Emotional Trading Usually Fail?

Why does emotional trading consistently fail? Simple: emotions make people buy high and sell low - the opposite of profitable trading. Fear triggers selling during the best buying opportunities. Greed drives buying during the worst market entries.

Research confirms what many traders learn the hard way. Average crypto investors consistently underperform market indexes because they buy during euphoric periods when prices are elevated and sell during fearful periods when prices are depressed. This destructive pattern destroys wealth over time.

How Can Traders Control Their Emotions?

Smart traders know the secret: develop systems that minimize emotional decision-making. These approaches help maintain discipline when markets get exciting or terrifying. The most effective strategies combine preparation with systematic execution.

Create Written Trading Plans

Written plans establish clear rules before emotions cloud judgment. These documents specify entry criteria, exit criteria, and position sizing rules. Following predetermined plans removes emotion from moment-to-moment decisions.

The best trading plans include specific scenarios and responses. They define exact actions to take during different market conditions. Writing down these rules in advance helps traders stick to them when emotions run high.

Use Systematic Approaches

Dollar-cost averaging eliminates timing decisions entirely. This strategy involves buying fixed amounts at regular intervals regardless of price. It removes the pressure to predict market tops and bottoms.

Stop-loss orders work like insurance policies for trades. Setting these levels in advance prevents emotional decisions during stressful periods. Many successful traders use stops on every single position.

Monitor Market Sentiment

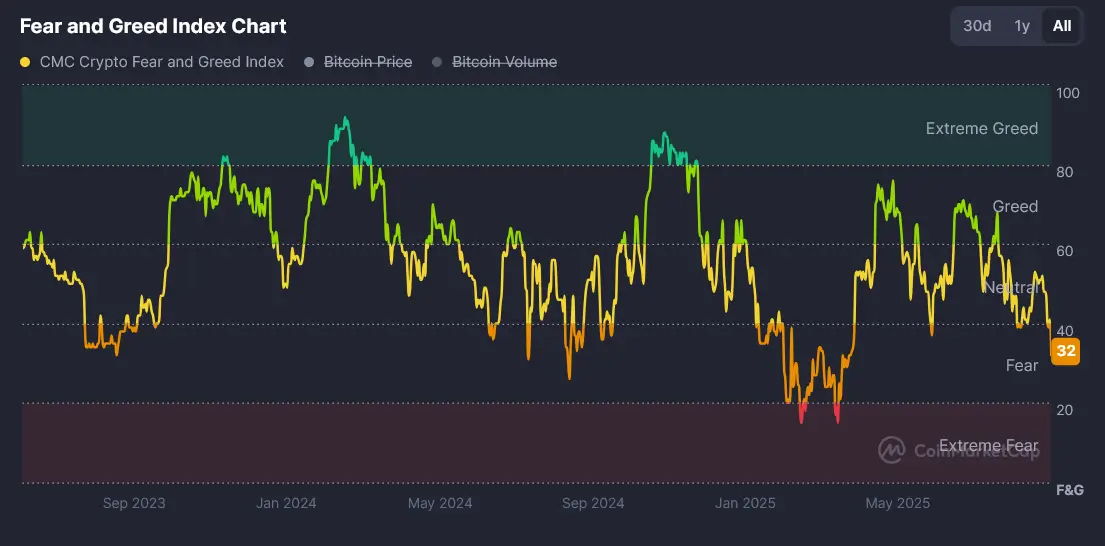

Sentiment indicators help identify when emotions reach extreme levels. High fear readings often signal good buying opportunities. Extreme greed readings often signal potential market tops.

Online monitoring provides real-time sentiment data. When discussions become overwhelmingly positive or negative, markets often reverse direction shortly afterward. Contrarian traders use this information to time their entries and exits.

What Are Common Psychological Trading Mistakes?

Several psychological biases consistently trap crypto traders. Recognizing these patterns helps avoid costly mistakes. These mental errors repeat across all market conditions and experience levels.

Confirmation Bias

Traders tend to seek information that confirms their existing beliefs while ignoring contradictory evidence. This leads to holding losing positions too long and missing warning signs about market changes.

Online platforms make confirmation bias worse by creating echo chambers. Traders follow accounts that share their opinions and avoid sources that challenge their views. This narrow information diet leads to poor decisions.

Overconfidence After Wins

Successful trades often create dangerous overconfidence. Traders start taking bigger risks and ignore proper risk management after a series of profitable trades. This behavior frequently leads to large losses that wipe out previous gains.

Overconfident traders also tend to overtrade, making too many transactions and paying excessive fees. They believe their recent success indicates that they can accurately predict future price movements.

Loss Aversion

People naturally hate losing money more than they enjoy making money. This psychological bias causes traders to hold losing positions too long while selling winning positions too quickly.

Loss aversion leads to poor portfolio management. Traders often keep bad investments, hoping they'll recover, while selling good investments to lock in small gains. This pattern prevents wealth building over time.

How Do Different Market Participants Affect Psychology?

Different market players create their own psychological pressures. Understanding these dynamics helps explain why markets move the way they do.

Retail traders show the strongest emotional responses. They buy during FOMO periods and sell during panic phases. Online platforms have a significant influence on their users' decisions, often leading to dangerous herd behavior.

Institutional investors generally maintain more discipline, but can still fall victim to career risk pressures. When institutions all adopt similar strategies, their coordinated actions can amplify market moves.

Algorithmic trading removes human emotion but can create mechanical feedback loops. When algorithms respond to the same signals simultaneously, they can trigger rapid price movements that seem emotionally driven.

What Role Does Social Media Play in Market Psychology?

Social media amplifies and accelerates emotional responses in crypto markets. Positive news spreads quickly during bull markets, creating FOMO. Negative news travels even faster during bear markets, increasing panic.

Influencers and prominent traders can trigger market-wide emotional responses with single posts. Their followers often make immediate trading decisions based on social media content without conducting independent research.

Online communities create psychological pressure to conform to group opinions. Members who express contrarian views often face criticism, which reinforces herd behavior and emotional decision-making.

How Can Traders Develop Better Market Psychology?

Building better market psychology takes consistent practice and discipline. Smart traders develop mental frameworks that keep them calm during volatile periods. Here are the key strategies that work:

- Accept Market Uncertainty: Markets are inherently unpredictable over short periods. Accepting this uncertainty helps traders focus on risk management rather than trying to predict every move. Smart traders prepare for multiple scenarios instead of betting everything on single outcomes.

- Focus on Process Over Results: Individual trade results contain significant randomness. Focusing on following proper processes and risk management leads to better long-term results than obsessing over single trades.

- Study Historical Patterns: Understanding how past market cycles developed helps recognize similar patterns in current markets. This knowledge provides context during emotionally charged periods, helping to maintain a clear perspective.

- Practice Mindfulness: Meditation and mindfulness practices help traders recognize their emotional states before making decisions. This self-awareness allows for better decision-making during stressful market periods.

What Makes Crypto Psychology Different From Traditional Markets?

Crypto psychology differs from traditional markets in key ways. The 24/7 trading schedule prevents emotional cooling-off periods that overnight closures provide in stock markets.

Volatility runs much higher too. Daily price swings of 10-20% are common in Bitcoin and other cryptocurrencies but rare in traditional markets. These dramatic movements trigger stronger emotional reactions.

Demographics matter as well. The younger crypto crowd often lacks experience with major bear markets. This inexperience leads to more emotional decision-making compared to traditional markets, which are often filled with seasoned participants.

Conclusion

Market psychology drives crypto price movements through predictable emotional cycles of fear and greed. Bull markets progress from optimism through excitement to euphoria. Bear markets move from denial through fear to capitulation. Successful traders recognize these patterns and use systematic approaches to minimize emotional decision-making. Understanding market psychology helps traders avoid common mistakes like buying high during FOMO periods and selling low during panic phases. While emotions will always influence markets, disciplined traders can use this knowledge to make better long-term investment decisions.

Sources

- Ackert, Lucy F., and Richard Deaves. "Behavioral Finance: Psychology, Decision-Making, and Markets." South-Western Cengage Learning, 2009.

- Federal Reserve Bank of St. Louis Economic Research.

- Shefrin, Hersh. "A Behavioral Approach to Asset Pricing." Academic Press, 2005.

- Kahneman, Daniel, and Amos Tversky. "Prospect Theory: An Analysis of Decision under Risk." Econometrica, Vol. 47, No. 2, 1979.

- Thaler, Richard H. "Misbehaving: The Making of Behavioral Economics." W. W. Norton & Company, 2015.

- CoinMarketCap - Market data.

Read Next...

Frequently Asked Questions

How does fear and greed affect crypto prices?

Fear causes mass selling that drives prices down, while greed creates buying frenzies that push prices up. These emotions often reach extremes in crypto markets, creating larger price swings than traditional assets. Smart traders watch for these emotional extremes as potential reversal signals.

What is market psychology in simple terms?

Market psychology is how the emotions of many traders combine to move prices. When most people feel scared, they sell and prices drop. When most people feel excited, they buy and prices rise. These emotional patterns repeat in predictable cycles.

How can I control emotions when trading crypto?

Create a written trading plan before entering positions and stick to it regardless of emotions. Use stop-losses to limit downside automatically. Practice dollar-cost averaging to remove timing pressure. Monitor your emotional state before making trading decisions.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

(Advertisement)

Latest News

(Advertisement)

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens