1inch DeFi Aggregator: Complete Guide to Cross-Chain Trading

Complete guide to 1inch DeFi aggregator: gas-free cross-chain swaps, tokenomics, governance, and technical architecture. Leading DEX aggregator analyzed.

Crypto Rich

August 30, 2025

Table of Contents

1inch stands as a leading decentralized exchange aggregator, solving DeFi's fundamental liquidity fragmentation problem. The platform scans dozens of exchanges in real-time to deliver optimal swap rates while protecting users from MEV (Maximal Extractable Value) attacks and minimizing slippage.

What makes this achievement remarkable is how 1inch transformed from a weekend hackathon project into DeFi's most trusted aggregation infrastructure. Today, the platform operates as a comprehensive DeFi ecosystem supporting cross-chain trading, mobile wallet functionality, and bridgeless interoperability. This technology addresses the security vulnerabilities that have plagued traditional bridging protocols.

What Problem Does 1inch Solve in DeFi?

Understanding DeFi's liquidity fragmentation problem helps explain why aggregation protocols like 1inch have become essential infrastructure for traders seeking optimal execution.

Decentralized finance suffers from severe liquidity fragmentation across hundreds of individual exchanges and automated market makers. Individual DEXs, such as Uniswap or SushiSwap, operate in isolation. This creates price inefficiencies and suboptimal trading experiences.

Traders seeking the best rates face multiple challenges:

- Manually checking prices across dozens of platforms

- Calculating gas costs for different routes

- Monitoring for MEV attacks and front-running

- Managing slippage tolerance across volatile markets

- Timing trades to avoid sandwich attacks

1inch eliminates this friction through its Pathfinder algorithm, which simultaneously queries multiple liquidity sources. The system automatically splits trades across multiple venues when beneficial, ensuring users receive optimal execution.

The platform's MEV protection shields users from front-running attacks through private routing and sophisticated order management. This preserves more value for end users compared to traditional DEX interfaces.

Cross-chain trading introduces additional complexity through traditional bridge protocols, which expose funds to smart contract risks. 1inch's native cross-chain swaps eliminate these dependencies, enabling secure direct trades between different blockchain networks.

How Did 1inch Begin and Evolve?

The evolution from hackathon project to DeFi infrastructure demonstrates sustained innovation and market adaptation.

The 1inch story began at ETHGlobal's New York hackathon on May 19, 2019. Developers Sergej Kunz and Anton Bukov built a prototype DEX aggregator called "1split" in just 36 hours. Their creation won the hackathon by demonstrating superior swap rates through trade splitting across multiple DEXes.

The team launched 1inch publicly on Ethereum by late 2019, featuring their Pathfinder routing algorithm. The platform gained rapid adoption during DeFi Summer 2020. Users discovered significant savings compared to single-DEX trading. Transaction volume grew from thousands to millions of dollars weekly as the protocol integrated more liquidity sources.

Early Growth and Token Launch

December 2020 marked a pivotal moment with the launch of the 1INCH token and community airdrop. The distribution rewarded early users based on their interaction history before a snapshot date. This approach bootstrapped decentralized governance while avoiding the venture capital dumping that plagued many competing protocols during the same period. The airdrop became one of DeFi's most successful governance token launches.

Institutional Recognition and Expansion

2021 brought explosive growth and institutional recognition. A $175 million Series B funding round led by Amber Group, Jane Street, and VanEck valued the company at over $2 billion. The team expanded to multiple blockchains. They launched on BNB Chain and Polygon to serve different user bases and gas cost preferences.

The 1inch DAO formally launched in December 2021, transferring governance control to token holders. This transition marked the protocol's evolution from startup to community-controlled infrastructure. DAO members now vote on fee structures, new chain integrations, and protocol upgrades.

Recent years have focused on technical innovation and enhancing user experience. The 2022 launch of Fusion mode enabled gas-free swaps through a resolver network, addressing one of DeFi's biggest user friction points. In 2023, the 1inch Wallet and Portfolio tracker were introduced, transforming the platform from a pure aggregator to a comprehensive DeFi suite that serves both casual users and professionals.

These developments positioned 1inch for its next major breakthrough in cross-chain interoperability, setting the stage for even more advanced technical solutions.

How Does 1inch's Technology Work?

Grasping 1inch's technical architecture reveals how the platform delivers superior trading outcomes compared to manual DEX selection or single-source trading.

The platform's technical architecture combines multiple protocols and algorithms to deliver optimal trading execution.

1inch operates as a meta-aggregator rather than a standalone exchange. When users initiate swaps, the Aggregation Protocol queries multiple DEXes simultaneously. The Pathfinder algorithm determines the optimal routing by utilizing graph theory to model liquidity pools as network nodes. It calculates the shortest path for any given trade.

Route Optimization

The system considers multiple variables, including pool depth, gas costs, slippage tolerance, and MEV risk when determining optimal routes. Trade execution often involves sophisticated order splitting across multiple venues. A $10,000 USDC to ETH swap might route 60% through Uniswap V3, 30% through Curve, and 10% through Balancer. This achieves better rates than any single source could provide. The algorithm recalculates routes in real-time as market conditions change, ensuring optimal execution even during volatile periods.

Gas Optimization and MEV Protection

The platform implements multiple layers of protection to reduce costs and shield users from value extraction attacks.

Gas Cost Reduction

Gas optimization represents another technical achievement. The protocol utilizes Fusion mode for gas-free execution via resolvers and batch processing, thereby reducing transaction costs. Smart contract interactions are minimized through efficient routing, which consolidates multiple swaps into single transactions whenever possible.

MEV Attack Prevention

MEV protection is achieved through private mempool routing and the prevention of sandwich attacks. The system detects potential front-running attempts and redirects trades through protected pools. This shields users from the value extraction that typically occurs in public mempools.

For traders, this translates to keeping more value from each swap instead of losing it to opportunistic bots and miners.

Cross-chain functionality relies on resolver networks rather than traditional bridges. Resolvers act like digital escrow agents, facilitating atomic swaps between different blockchains. They provide liquidity on the destination chain while the user's tokens are locked on the source chain. This eliminates custody risks associated with bridge protocols.

For users, this means secure cross-chain trading without the bridge vulnerabilities that have cost the DeFi ecosystem billions in losses.

What Products and Features Does 1inch Offer?

Exploring 1inch's product suite helps users identify which tools best serve their specific DeFi needs, from basic swaps to advanced portfolio management.

Beyond basic aggregation, 1inch has developed a comprehensive suite of DeFi tools that serve different user needs:

- Cross-chain swaps enable direct trading between multiple networks

- Fusion mode provides gas-free transactions through resolver competition

- Mobile wallet with integrated portfolio management

- Developer APIs powering integrations across major DeFi platforms

- Physical and virtual cards bridging DeFi to traditional payments

- Advanced order types, including limits and partial fills

This ecosystem approach transforms 1inch from a simple aggregator into a full-service DeFi platform.

Cross-Chain Swaps and Fusion Mode

The platform's cross-chain functionality depicts a significant breakthrough in DeFi interoperability, offering multiple execution modes tailored to different user needs.

Cross-Chain Capabilities

Cross-chain swaps enable direct trading between supported networks, including Ethereum, Solana, Polygon, Arbitrum, Optimism, and Avalanche. The recent Solana integration allows seamless EVM-to-Solana trades. This represents an industry first in bridgeless interoperability.

Key technical advantages include:

- Atomic Settlement: Trades execute completely or fail completely, preventing partial losses

- No Bridge Dependencies: Direct chain-to-chain swaps without intermediate custody

- Resolver Competition: Multiple parties compete to provide the best execution rates

- MEV Protection: Cross-chain trades benefit from the same front-running protection as single-chain swaps

Fusion Mode Benefits

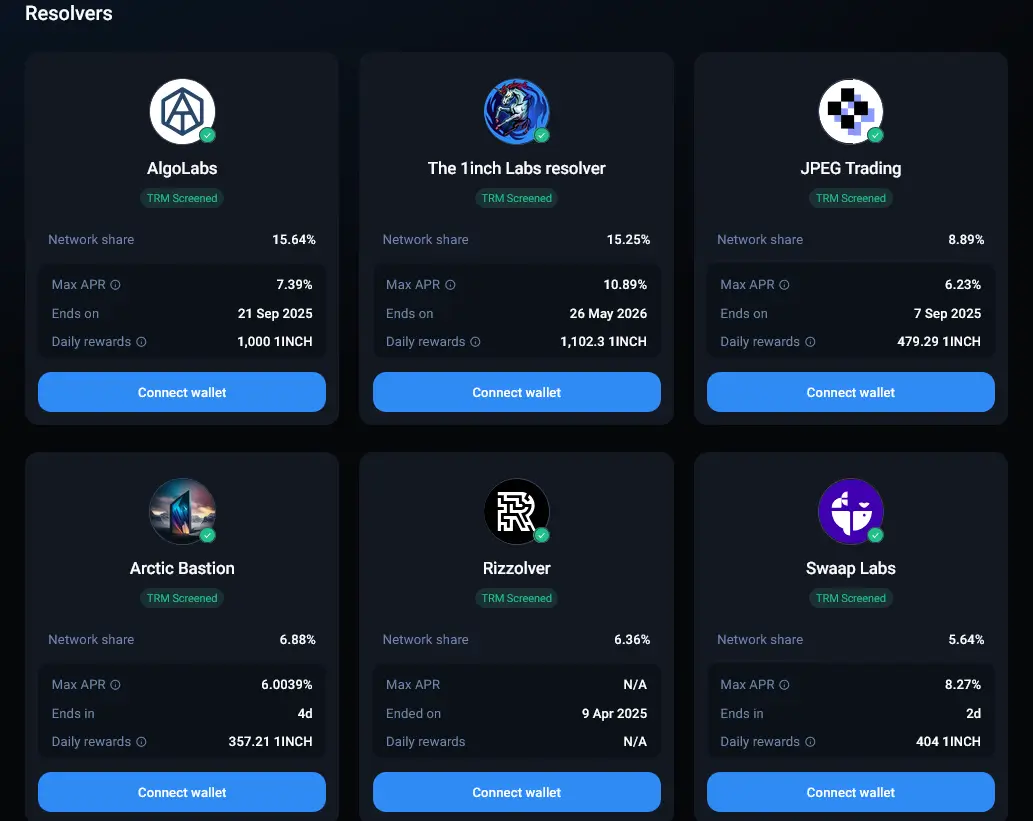

Fusion mode provides users with completely gas-free trading through a network of resolvers that compete to execute trades. Users submit orders that resolvers fulfill, covering all gas costs and earning fees while providing better execution. This system eliminates gas fees entirely for users while creating sustainable incentives for resolver operators. Resolvers exploit arbitrage opportunities to generate profits, which they distribute as rewards to users who delegate Unicorn Power to them (detailed in the tokenomics section).

MEV protection comes standard across all swap types. The platform's sandwich attack prevention and private routing preserve more value for traders compared to direct DEX interfaces.

Mobile Wallet Features

The 1inch mobile application offers comprehensive DeFi access through user-friendly interfaces, catering to both beginners and advanced users.

Core Wallet Functionality

The mobile wallet app supports iOS and Android with comprehensive DeFi functionality:

- Store assets and execute swaps across multiple chains

- Connect to dApps with an integrated Web3 browser

- Manage portfolios with detailed analytics and tracking

- Hardware wallet integration for enhanced security

- Payment requests via QR codes and shareable links

This functionality bridges the gap between DeFi complexity and mainstream usability, making cryptocurrency payments as simple as traditional payment apps.

Portfolio Management

The Portfolio tracker aggregates holdings across all supported chains with detailed analytics. Users can monitor performance, track transaction history, and analyze asset allocation without needing to switch between multiple interfaces.

1inch Card and Real-World Integration

Physical and virtual payment cards bridge the gap between decentralized finance holdings and traditional commerce applications.

Card Integration

Physical and virtual crypto cards allow for direct spending of DeFi holdings. The cards support both online and in-person purchases, bridging decentralized assets with traditional payment infrastructure.

Card integration with the 1inch ecosystem allows automatic conversion from any supported token to fiat at the point of sale. This eliminates the need for manual conversions while preserving the benefits of DeFi asset management.

Developer Integration Tools

The 1inch Developer Portal at portal.1inch.dev provides comprehensive APIs for integration. Major DeFi platforms rely on 1inch infrastructure to power their swap functionality.

Key developer resources include:

- SDK availability across multiple programming languages

- Documentation covering basic swaps to advanced routing

- Rate limiting and authentication for reliable service

- Enterprise partnerships with dedicated support

- Enhanced API access for institutional users

These tools enable rapid integration for developers building DeFi applications while maintaining technical sophistication.

What Powers 1inch's Technical Architecture?

The protocol's infrastructure consists of multiple interconnected smart contract systems that work together to provide aggregation and routing capabilities.

Pathfinder Algorithm Mechanics

The Aggregation Protocol is 1inch's core infrastructure, implementing advanced routing algorithms to deliver optimal trade execution across multiple blockchain networks.

Smart Contract Infrastructure

The system implements the Pathfinder routing algorithm through smart contracts deployed across each supported blockchain. These contracts maintain real-time connections to local DEXes and automated market makers.

Liquidity Source Integration

The system connects to multiple liquidity source types across the DeFi ecosystem. Standard trading pairs flow through constant-product AMMs, such as Uniswap V2/V3 and SushiSwap. For efficient stablecoin trades, the platform taps into specialized pools from Curve Finance and Belt. Capital efficiency gets maximized through concentrated liquidity sources such as Uniswap V3 and Algebra.

Beyond traditional AMMs, 1inch integrates with order book DEXes, including dYdX and Serum for additional depth. Private pools with MEV protection complete this comprehensive source network, ensuring optimal routing across all available liquidity types.

Graph Theory and Route Calculation

Pathfinder uses advanced graph theory to model these liquidity networks, essentially acting as a "GPS system" for cryptocurrency trades. Each pool becomes a node with edges representing potential trades. The algorithm calculates optimal paths by considering multiple factors. Gas costs, slippage tolerance, available liquidity depth, and current network congestion all influence routing decisions.

Route optimization occurs through dynamic programming techniques. The system rapidly evaluates millions of potential combinations. It identifies whether splitting trades across multiple venues provides better execution than single-source routing. For traders, this means better prices and lower costs, without the need for manual comparison shopping across dozens of platforms.

Smart Contract Architecture

The protocol's smart contract systems enable advanced trading functionality beyond basic swaps, incorporating traditional finance features into DeFi infrastructure.

Order Management

The Limit Order Protocol enables conditional trading beyond simple market orders. Users can set specific price targets and partial fill preferences. They can also configure time-based execution parameters. Smart contracts automatically execute orders when market conditions meet user specifications. This provides traditional trading functionality within the DEX aggregator framework.

Order management includes cancellation capabilities and partial fill handling. Users maintain full control over their orders without sacrificing the benefits of automated execution. The system bridges the gap between DeFi flexibility and traditional finance order types.

Liquidity Protocol and Security

The 1inch Liquidity Protocol operates as an automated market maker with advanced MEV protection. Unlike traditional AMMs, it implements time-weighted average pricing (TWAP) to prevent front-running attacks.

Liquidity providers earn fees while benefiting from reduced impermanent loss through the use of sophisticated rebalancing algorithms. The system optimizes capital efficiency while maintaining price stability across volatile market conditions.

Comprehensive security measures include:

- Audits by leading firms such as PeckShield, Certik, and ConsenSys Diligence

- Bug bounty programs offering up to $1 million for critical vulnerabilities

- Multi-signature governance controls prevent single points of failure

- Multiple audit rounds covering smart contract code and economic models

- White-hat security research incentives for ongoing threat protection

Capital deployment strategies automatically adjust pool parameters based on market conditions, maximizing returns while ensuring consistent liquidity availability.

How Do 1inch Tokenomics Work?

Understanding 1INCH tokenomics is crucial for anyone considering governance participation, staking rewards, or long-term holding strategies within the ecosystem.

The 1INCH token serves multiple functions within the protocol ecosystem. Token holders stake 1INCH to earn "Unicorn Power" for voting on protocol proposals and parameter changes. The system includes governance rights, protocol parameter control, treasury management, and emergency powers for critical security decisions.

Staking periods range from one month to two years. Longer commitments earn greater voting weight. This time-weighting system incentivizes long-term thinking over short-term speculation. Instant governance capabilities allow rapid parameter adjustments for time-sensitive changes.

A key utility is delegation: Unicorn Power can be delegated to resolvers to earn rewards, rather than solely for voting. Delegation occurs to one resolver at a time, with rewards accruing per block and claimable at any time (rewards can be restaked for additional Unicorn Power). Resolvers distribute rewards from their arbitrage profits ("positive delta" per swap), proportional to delegated Unicorn Power. Estimated APRs vary and decrease with the addition of more delegators, creating a primary incentive for staking beyond governance. Early unstaking is possible, but with penalties, if the remaining lock period exceeds 10% of the total time.

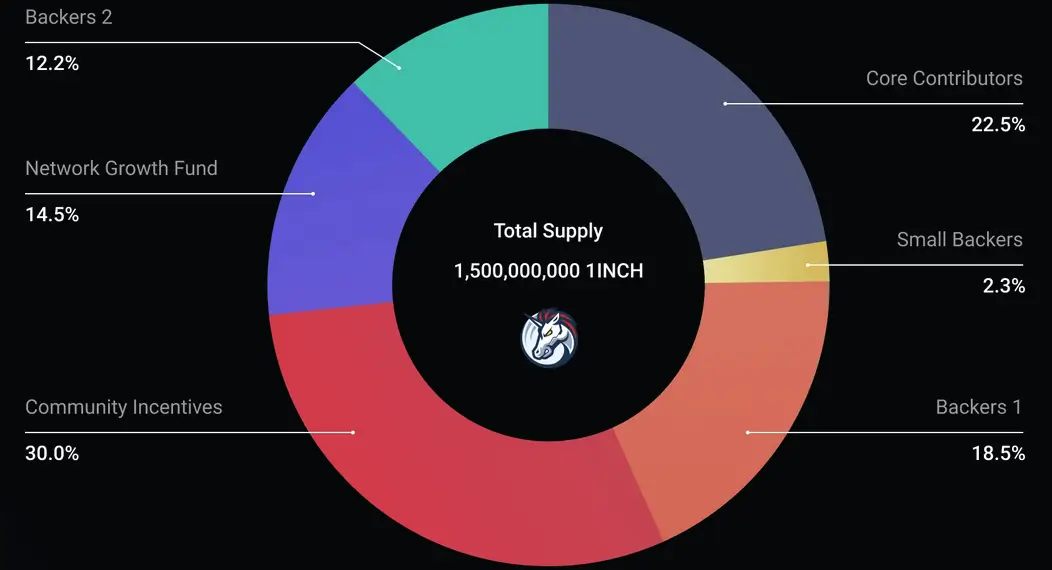

Token Distribution Model

Initial distribution allocated tokens across multiple stakeholder categories, designed to ensure long-term protocol sustainability:

- Community Incentives: 30% -- Allocated for liquidity mining and community rewards to bootstrap adoption and network security

- Core Contributors: 22.5% -- Reserved for the team and future employees and for long-term development

- Network Growth Fund: 14.5% -- Used for grants, developer incentives, research, and ecosystem expansion (e.g., partnerships and integrations)

- Backers 2: 12.2% -- Additional allocation for later-round investors.

- Small Backers: 2.3% -- Dedicated to early liquidity providers (e.g., from Mooniswap) and smaller supporters

How Does 1inch Governance and DAO Function?

Community governance operates through a decentralized autonomous organization that gives token holders control over protocol development and resource allocation.

Governance Structure

The 1inch DAO launched in December 2021, establishing community governance over protocol development and treasury management. Token holders control all aspects of the protocol through democratic voting processes. Think of it as a digital cooperative where stakeholders collectively steer the platform's direction.

Governance participation requires staking 1INCH tokens to earn Unicorn Power. Voting weight is determined by both the token quantity and staking duration. This encourages long-term commitment over short-term speculation.

Delegation Mechanics

Delegation of Unicorn Power to resolvers is a core participation mechanic: Beyond voting, stakers delegate to attract rewards from resolver operations, funded by arbitrage profits from Fusion mode swaps. This ties governance to ecosystem operations, as resolvers must be verified (through processes including TRM Labs screening and KYC/KYB) and compete for delegations.

Proposal Process

Proposal submission requires minimum token thresholds to prevent spam while ensuring legitimate community voices can participate. Discussion periods precede voting to enable thorough consideration of proposed changes. For token holders, this means real influence over features, fees, and strategic decisions rather than passive investment.

Instant governance capabilities enable swift decision-making for time-sensitive tasks, such as security updates or market condition responses. These fast-track procedures maintain protocol security while preserving democratic oversight.

DAO Treasury and Community Oversight

The DAO treasury receives funding from protocol fees and token allocations. Community proposals determine spending priorities including:

- Grant programs supporting ecosystem development and research projects

- Partnership funding for strategic collaborations and integrations

- Development initiatives chosen by token holders through democratic voting

- Security audits and bug bounty program funding

Application processes ensure fair distribution while maintaining quality standards. Partnership decisions involve community evaluation of strategic relationships that require treasury resources or protocol modifications.

Regular community calls provide forums for discussion before formal votes. These sessions enable stakeholders to share perspectives and reach consensus on complex issues.

Working groups focus on specific areas like security, marketing, or technical development. These specialized committees provide expert analysis to inform broader community decisions.

Governance evolution continues through community proposals for improving decision-making processes. The DAO can modify its own operational procedures through democratic votes.

What Ecosystem and Partnerships Define 1inch?

Strategic relationships and integrations extend 1inch's capabilities while expanding access to its aggregation technology.

The 1inch ecosystem encompasses extensive liquidity sources serving millions of users through strategic partnerships with leading platforms and infrastructure providers. Major platform integrations extend 1inch's reach across the DeFi ecosystem:

- MetaMask Integration: Direct swap access for millions of browser wallet users

- Trust Wallet Partnership: Mobile DeFi functionality for smartphone-first users

- Revolut Collaboration: Traditional fintech bridge bringing crypto to banking customers

- Hardware Wallet Support: Ledger integration for institutional-grade security

- Exchange Partnerships: API integrations powering swap functionality across platforms

These partnerships collectively serve over 100 million users worldwide. They extend 1inch's aggregation technology far beyond its native interfaces.

Security Partnerships

1inch's security partnerships form a critical defense layer against fraud and illicit activities while ensuring regulatory compliance across multiple jurisdictions.

TRM Labs and Beacon Network Integration

The August 2025 partnership with TRM Labs integrates the Beacon Network, a decentralized alert system for real-time detection of crypto crimes. This collaboration enables 1inch to monitor transactions across its aggregation protocol, identifying patterns associated with money laundering, scams, or sanctioned entities before they impact users.

The integration provides real-time monitoring through AI-driven models that analyze on-chain data for red flags like unusual wallet behaviors or links to known illicit addresses. The decentralized alert system allows participating protocols to share anonymized threat intelligence without compromising user privacy.

For traders, this translates to enhanced token warnings in the 1inch app, including alerts for potentially risky assets or counterparties. Similar systems have blocked millions in fraudulent transactions across DeFi platforms.

Regulatory Compliance Framework

Partnerships with firms like TRM Labs enable 1inch to navigate complex global regulations while upholding its decentralized principles. These collaborations provide AML and sanctions tools that help 1inch comply with regulations across multiple jurisdictions, including the EU's MiCA framework and U.S. SEC guidelines.

Sanctions screening via TRM Labs prevents inadvertent exposure to OFAC-sanctioned addresses, which is particularly crucial for cross-chain swaps where funds move seamlessly between jurisdictions. This compliance framework, which includes public blocklists from Circle and Tether, facilitates integrations with traditional finance players, thereby bridging DeFi with mainstream financial systems.

Developer Ecosystem and Innovation

Over 20 projects integrate 1inch APIs to power their swap functionality. These integrations extend 1inch's reach while providing developers with proven aggregation technology.

Hackathon sponsorships and developer events foster innovation within the ecosystem. Programs like ETHGlobal partnerships identify new use cases and integration opportunities.

Educational initiatives and documentation support developer adoption. Comprehensive guides and examples reduce integration barriers while maintaining technical sophistication.

How Does 1inch Compare to Competitors?

Comparing 1inch with alternatives helps users choose the right aggregator for their trading style, whether prioritizing gas efficiency, cross-chain capabilities, or user experience.

The DEX aggregator market includes several competitors with different approaches to solving liquidity fragmentation and trading optimization challenges.

Direct Aggregator Comparison

0x Protocol provides professional-grade aggregation services, featuring advanced order types and institutional-grade features. However, independent testing shows 1inch delivers superior gas optimization and MEV protection through its private routing capabilities. 0x focuses primarily on API integrations for other platforms rather than direct user interfaces.

Paraswap competes directly in the European market with similar aggregation functionality. The platform serves regional users well through localized interfaces and compliance features. However, it lacks 1inch's comprehensive cross-chain capabilities and has a limited presence in Asian and American markets.

Matcha provides polished user interfaces but relies entirely on the underlying 0x infrastructure for trade execution. 1inch's integrated approach offers more control over the complete user experience, from route optimization to MEV protection implementation.

OpenOcean aggregates liquidity across 40+ chains (including EVM and Solana) with features like perpetuals, tokenized stocks, and yield tools via partners like Pendle. It's free-to-use like 1inch but includes CeFi sources for broader depth. Both platforms offer comprehensive cross-chain aggregation, though they differ in their approach to MEV protection and bridge-free execution methodologies.

Single DEX Platforms

Uniswap operates as a single DEX rather than an aggregator, limiting users to one liquidity source. While Uniswap has deeper liquidity for major pairs, 1inch provides better rates through multi-source routing. SushiSwap offers competitive rates but lacks aggregation capabilities. Users must manually compare prices across platforms, while 1inch automates this process.

Curve specializes in stablecoin trading with superior rates for like-kind assets. However, 1inch incorporates Curve liquidity within broader routing strategies. This provides users with access to Curve's benefits, as well as additional optimization opportunities.

Bridgeless cross-chain trading represents 1inch's most significant competitive advantage. Traditional solutions expose users to bridge risks that have caused billions in losses annually. Gas-free execution via Fusion mode and efficient routing provides measurable cost savings. Independent testing demonstrates superior performance compared to direct DEX usage. MEV protection shields users from value extraction that occurs on other platforms. This protection preserves more value for end users compared to unprotected trading venues.

What Challenges and Risks Face 1inch?

Evaluating potential risks helps users and investors make informed decisions about protocol usage and token holdings while understanding the broader DeFi landscape challenges.

Like all DeFi protocols, 1inch faces various categories of risks that could impact operations, user adoption, and long-term sustainability.

Technical and Regulatory Risks

Complex multi-chain architecture increases attack surface area compared to single-chain alternatives. More components mean more potential failure points. Dependency on external DEX protocols creates systemic vulnerabilities that could affect aggregation capabilities. If major liquidity sources like Uniswap experience issues, 1inch's effectiveness could diminish.

Resolver network security relies on economic incentives rather than cryptographic guarantees. This introduces potential failure points. However, the economic model has proven robust in practice.

Regulatory uncertainty affects all DeFi protocols. Cross-chain functionality may face scrutiny as authorities develop multi-blockchain frameworks. Different jurisdictions employ varying approaches to DeFi regulation, resulting in compliance challenges. Token classification uncertainty could affect governance utility and exchange access across different markets.

For users and investors, these risks highlight the importance of diversification and understanding the evolving regulatory landscape.

Competition from centralized exchanges offering superior liquidity for institutional trades poses ongoing challenges. New aggregation technologies could potentially erode technical advantages over time. Extended bear markets reduce overall DeFi activity, impacting protocol revenues and development funding capacity.

What Recent Developments Shape 1inch's Future?

Tracking 1inch's latest innovations provides insight into the protocol's strategic direction and potential opportunities for users, developers, and token holders.

Current innovations and strategic initiatives position the protocol for continued growth and adaptation to evolving DeFi market conditions.

Solana Integration Benefits

The August 2025 Solana integration marks a significant technical milestone. It enables direct EVM-to-Solana swaps without traditional bridge protocols. This capability addresses one of DeFi's most pressing infrastructure challenges. Native cross-chain functionality reduces complexity and costs for users operating across multiple blockchains. The technology could expand to additional networks as 1inch continues developing bridgeless solutions.

Performance improvements through Solana's 400-millisecond block times provide faster execution compared to Ethereum's 12-second blocks. Users benefit from reduced waiting times and improved user experience. Mobile and accessibility improvements enhance DeFi access with better interfaces and additional features. The focus on mobile reflects the growing adoption of smartphones for crypto activities.

Mobile Platform Evolution

Payment functionality through QR codes and shareable links bridges DeFi complexity with mainstream usability expectations. These features support broader cryptocurrency adoption beyond technical users. Card integration enables direct spending from DeFi holdings, connecting decentralized assets with traditional payment infrastructure. This capability addresses the practical challenge of using crypto for everyday purchases.

DAO treasury growth through protocol fees provides sustainable funding for ecosystem development. Community control over these resources ensures alignment with user priorities rather than corporate objectives. Governance participation increases as token holders become more engaged with protocol decisions. Active participation strengthens decentralized governance while improving decision quality. Community events and partnerships foster ecosystem growth through collaboration with other projects and developers.

Conclusion

1inch has established itself as the leading DeFi aggregator through technical innovation, user-focused design, and community governance. The protocol demonstrates how decentralized infrastructure can solve real problems while serving millions of users across multiple blockchain networks.

The platform's evolution from a simple aggregator to a comprehensive DeFi ecosystem reflects the broader maturation of decentralized finance. Bridgeless cross-chain trading, MEV protection, and gas-free execution provide tangible benefits that extend beyond speculative trading.

As decentralized finance continues to develop, 1inch's focus on efficiency, security, and user experience positions it well for sustained growth. The platform serves traders seeking better rates, developers building DeFi applications, and institutions requiring reliable access to decentralized liquidity.

Visit the official 1inch website for more information and follow @1inch on X for the latest updates.

Sources:

Read Next...

Frequently Asked Questions

What makes 1inch different from other DEX aggregators

1inch combines gas-free trading through Fusion mode, advanced MEV protection, and bridgeless cross-chain trading across 13+ networks. Its Pathfinder algorithm and 3.2 million liquidity sources provide better execution than its competitors.

How does 1inch's cross-chain trading work without bridges?

1inch uses resolver networks for atomic swaps between blockchains. Resolvers provide liquidity on destination chains while source tokens remain locked, eliminating bridge custody risks.

What are the benefits of 1inch's Fusion mode?

Fusion mode offers gas-free trading through competing resolvers who earn fees by executing trades. Users save on transaction costs while resolvers provide better execution through competitive bidding.

How does 1INCH token governance actually work?

Token holders stake 1INCH to earn Unicorn Power, which enables them to vote on protocol changes. Staking duration affects voting weight, encouraging long-term participation. The DAO controls treasury spending and development priorities.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens