What is Hyperliquid (Hype), and How Does it Work?

Learn how Hyperliquid’s layer-1 blockchain powers on-chain trading, liquidity, and token launches through its HyperCore and HyperEVM systems.

Miracle Nwokwu

October 17, 2025

Table of Contents

Hyperliquid is a layer-1 blockchain tailored specifically for financial operations, where trading liquidity, user-facing applications, and token launches come together on a single platform. At its core, the project aims to create an open system that handles all aspects of finance directly on-chain, allowing participants to interact without intermediaries. This setup enables developers and users to build and trade in a unified environment, which has drawn attention from both individual traders and larger entities.

While the blockchain launched its mainnet features progressively, including the HyperEVM in early 2025, it has maintained consistent performance even during periods of high market activity. The project's native token, HYPE, plays a central role in facilitating transactions and governance, tying the ecosystem together in a way that rewards active involvement.

Founded with a focus on performance and decentralization, Hyperliquid differentiates itself through custom-built components that address common bottlenecks in blockchain-based finance. For instance, its consensus mechanism ensures quick finality for trades, which is crucial for high-frequency activities like perpetual futures trading. As the platform has evolved, it has incorporated feedback from its community, leading to features like permissionless asset deployments and specialized contract types. This approach has fostered a growing ecosystem, with integrations such as the one with MetaMask enabling easier access to perpetual trading directly from mobile wallets. Overall, Hyperliquid provides tools that make complex financial operations more accessible.

Technical Overview

Hyperliquid’s architecture revolves around a custom consensus algorithm known as HyperBFT, which draws inspiration from protocols like Hotstuff while incorporating optimizations for the demands of a financial blockchain. HyperBFT delivers one-block finality, meaning transactions confirm rapidly and irreversibly, a feature that supports the platform's emphasis on real-time trading. This consensus layer underpins the entire system, handling everything from network communication to state execution without the latency issues that plague some other blockchains. During the October 10 market volatility, for example, Hyperliquid processed record volumes with no downtime, demonstrating the robustness of its design.

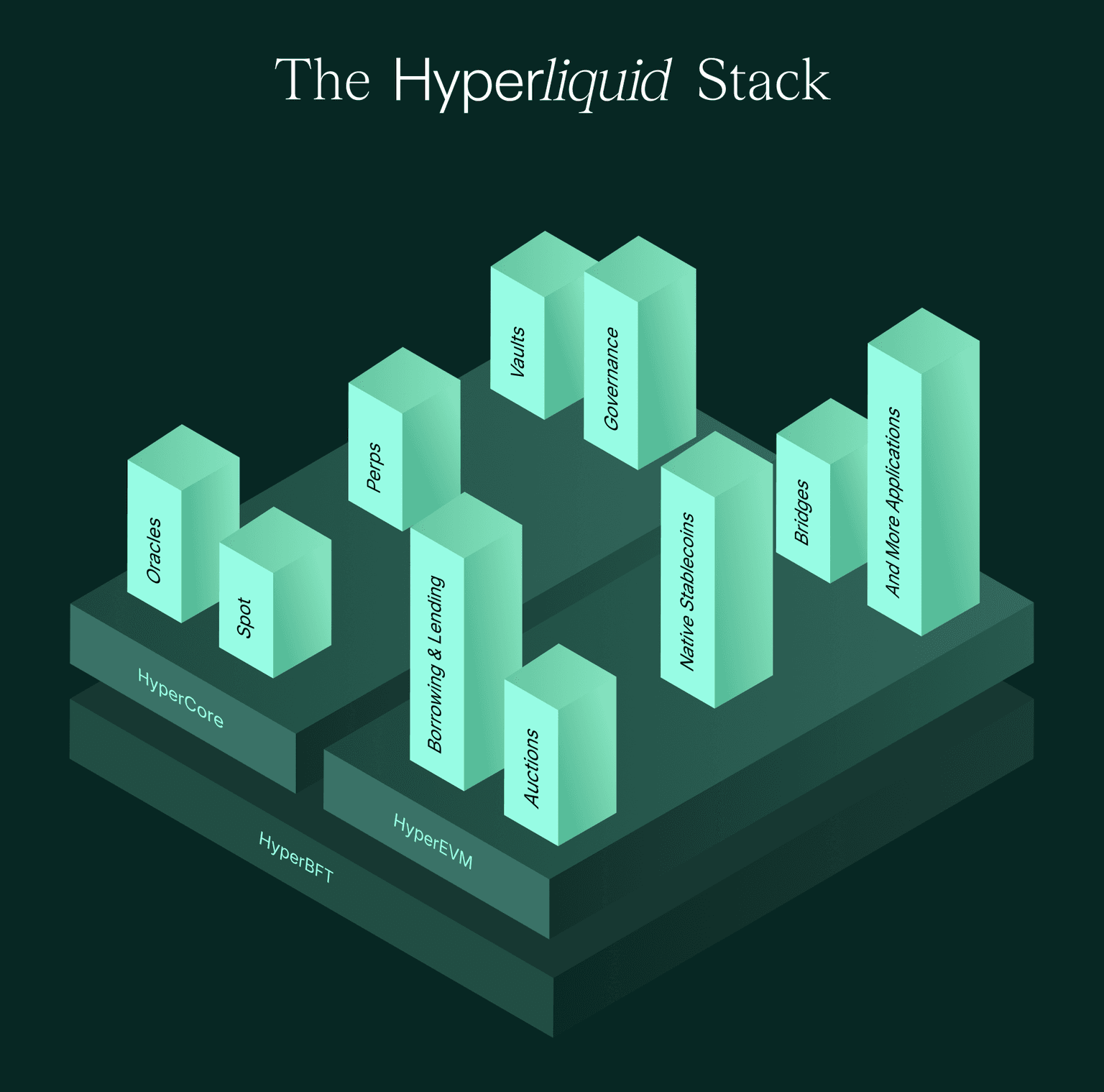

State execution on Hyperliquid divides into two main parts: HyperCore and HyperEVM. HyperCore manages the native trading functions, such as perpetual futures and spot order books, all executed transparently on-chain. It currently supports up to 200,000 orders per second, with ongoing improvements to throughput as the node software receives updates. Complementing this, the HyperEVM brings Ethereum-compatible smart contract functionality to the chain, allowing developers to deploy general-purpose applications that interact seamlessly with HyperCore's liquidity.

The HyperEVM operates on the Cancun hardfork specifications, complete with EIP-1559 for dynamic fee adjustments, and uses HYPE as its gas token. Fees, including both base and priority components, are burned to maintain economic balance, with base fees reducing the total supply and priority fees sent to a null address. This integration means smart contracts can read Hyperliquid's layer-1 state via precompiles and execute actions through the CoreWriter contract, opening doors to innovative financial primitives like lending protocols or tokenized vaults.

Developers access the HyperEVM via JSON-RPC endpoints, with chain IDs set at 999 for mainnet and 998 for testnet. While there are no official frontends yet, users can connect wallets directly or build custom interfaces, making it straightforward to port existing Ethereum tools. The absence of blobs in the hardfork keeps things lightweight, prioritizing speed over additional data storage features. Together, these elements create a blockchain that not only handles high-volume trading but also supports a broad range of decentralized applications, all secured by the same consensus protocol.

HyperCore in Detail

HyperCore forms the backbone of Hyperliquid's trading capabilities, embedding fully on-chain perpetual futures and spot order books directly into the blockchain's execution layer. Every action—whether placing an order, canceling one, executing a trade, or processing a liquidation—occurs with the same one-block finality provided by HyperBFT. This transparency ensures that all participants can verify activities in real time, reducing the need for trust in centralized operators. Performance-wise, HyperCore's optimization allows for substantial throughput, which continues to scale as the underlying software improves.

One notable feature within HyperCore is the support for hyperps, a type of perpetual contract unique to Hyperliquid. Hyperps function similarly to traditional perps but eliminate the reliance on external spot or index oracles. Instead, they use an eight-hour exponentially weighted moving average of the contract's own mark prices to determine funding rates. This mechanism enhances stability and resists manipulation, particularly for assets in pre-launch phases.

For example, if momentum pushes the price sharply in one direction, funding rates adjust to encourage counter-positions over the following eight hours. Mark prices incorporate a weighted median from centralized exchange pre-launch perps for added reliability, with caps in place to prevent extreme deviations—the mark price cannot exceed 10 times the eight-hour EMA, and the oracle price is limited to four times the monthly average. Once the underlying asset lists on major spot markets like Binance or OKX, the hyperp converts automatically to a standard perp, increasing leverage options from the initial 3x limit. Traders should note the isolated margin requirement and potential for high volatility in these contracts.

HyperCore's design also facilitates seamless integration with the HyperEVM, enabling smart contracts to leverage its liquidity for more complex applications. This synergy positions HyperCore as a foundational layer for building efficient financial tools, where speed and security align to handle demanding workloads.

The HYPE Token: Tokenomics and Utility

HYPE serves as the native token of the Hyperliquid ecosystem, powering transactions, governance, and network security. With a maximum supply capped at 1 billion tokens, its distribution emphasizes long-term participation and community involvement. Approximately 38.888% of the supply allocates to future emissions and rewards for contributors, while 31% went to a genesis airdrop for early supporters.

Additional portions support team efforts, advisors, and ecosystem development, though recent proposals have explored reducing the overall supply to enhance stability and remove the hard cap. As of now, the circulating supply stands around 336 million tokens, reflecting a measured release schedule that avoids sudden floods.

In terms of utility, HYPE functions primarily as the gas token for both HyperCore and HyperEVM operations. Users pay gas fees in HYPE for deployments, such as launching spot assets, and these fees contribute to a buyback mechanism where protocol revenue repurchases tokens, potentially supporting value over time.

Beyond fees, HYPE enables staking for validators, allowing holders to participate in securing the network and earning rewards. Governance aspects let token holders vote on proposals, including protocol upgrades or parameter changes, fostering a decentralized decision-making process. For instance, to run a validator node, one needs at least 10,000 HYPE, combined with vetting, which helps maintain network integrity. This multifaceted role makes HYPE integral to daily operations, from simple trades to complex smart contract executions, while encouraging holders to engage actively with the platform.

Hyperliquid Vaults

Vaults on Hyperliquid offer a way for users to pool funds and follow automated trading strategies, built directly into HyperCore for efficiency. Essentially, a vault acts as a shared wallet managed by a leader—either an individual trader or an automated system—who executes trades on behalf of depositors. This setup allows participants to benefit from professional strategies without managing positions themselves, democratizing access to advanced tactics like market-making or funding rate arbitrage.

There are various types, including protocol vaults like the Hyperliquidity Provider (HLP), which handles market-making and liquidations while earning a share of trading fees. Users deposit stable assets or other tokens into a vault, and the leader deploys them across perpetuals or spots. Profits distribute proportionally after fees, which typically include a performance cut for the leader. Creating a vault involves setting parameters via the platform's interface, and depositors can withdraw at any time, subject to ongoing positions. Benefits include passive exposure to sophisticated trades, but risks arise from leader performance, market volatility, and potential liquidations. Analysis of top vaults shows varied user bases, with some attracting large institutional deposits and others smaller retail ones, highlighting the flexibility of the system. Vaults leverage HyperCore's features, such as high-speed order execution, to run strategies that mirror those on the main DEX.

How Listing Works on Hyperliquid

Listings on Hyperliquid operate in a permissionless manner, removing barriers like fees or approval processes found on centralized exchanges. Anyone can deploy a spot asset by paying a gas fee in HYPE, making the process accessible and transparent. Deployers can opt to receive up to 50% of the trading fees generated from their pairs, incentivizing quality additions while keeping everything verifiable on-chain.

For new tokens, the HIP-1 standard facilitates launches through Dutch auctions, where initial liquidity sets via community bidding. Additional pairs between existing assets can also deploy via separate auctions, independent of the token launch. Stable assets may qualify as quote currencies if they meet on-chain criteria, as seen with USDH becoming the first permissionless quote asset. Community requests often drive perp listings, with hyperps serving as a bridge for unlaunched tokens until spot availability. This full lifecycle—building, launching, and trading—happens entirely on Hyperliquid, empowering projects to go from idea to market without gatekeepers.

Ecosystem Developments and Future Outlook

Hyperliquid's ecosystem continues to expand through community-driven initiatives and partnerships. Recent additions include hyperps for assets like Monad and Meteora, responding directly to user input. The platform has also distributed NFTs, such as the Hypurr collection, to early contributors as a nod to their support, with 4,600 unique pieces deployed on the HyperEVM. Events like fireside chats at Token2049 have highlighted topics such as ecosystem growth and stablecoins, drawing engaged audiences.

Hyperliquid's commitment to performance and openness positions it well for broader adoption. Integrations with tools like MetaMask and ongoing optimizations ensure it remains a viable option for traders and builders.

Sources:

- Hyperliquid Documentation: https://hyperliquid.gitbook.io/hyperliquid-docs

- EIP-1559 Overview (Binance Academy): https://www.binance.com/en/academy/glossary/eip-1559

Read Next...

Frequently Asked Questions

What is Hyperliquid, and how does it work?

Hyperliquid is a layer-1 blockchain designed for financial operations such as trading, liquidity management, and token launches. It combines HyperCore, which handles on-chain trading functions, with HyperEVM, which adds Ethereum-compatible smart contracts. This integration allows users and developers to build, trade, and deploy financial applications directly on-chain without intermediaries.

What makes Hyperliquid different from other blockchains?

Hyperliquid differentiates itself through its custom-built consensus mechanism, HyperBFT, which provides one-block finality for rapid and irreversible transactions. It’s optimized for real-time financial activity like perpetual futures trading and offers permissionless listings, meaning anyone can deploy a token or trading pair without approval.

How does the HYPE token function in the Hyperliquid ecosystem?

The HYPE token serves as the native currency for gas fees, governance, staking, and validator rewards. Users pay gas fees in HYPE for all operations, including asset launches, and can stake HYPE to help secure the network. Additionally, part of the protocol’s revenue is used to buy back HYPE tokens, helping maintain economic balance and potentially supporting its long-term value.

What are HyperCore and HyperEVM, and how do they interact?

HyperCore is Hyperliquid’s native trading engine, responsible for executing spot and perpetual futures orders directly on-chain with one-block finality. HyperEVM, on the other hand, brings Ethereum Virtual Machine compatibility, enabling developers to create smart contracts that interact seamlessly with HyperCore’s liquidity. Together, they form a unified system that supports both trading and decentralized applications efficiently.

How can developers and users participate in the Hyperliquid ecosystem?

Developers can connect via JSON-RPC endpoints and deploy smart contracts using Ethereum tools, while traders can access Hyperliquid directly through integrations like MetaMask. Users can also stake HYPE, join Hyperliquid Vaults to follow automated trading strategies, or deploy new assets permissionlessly. This inclusive design allows both builders and traders to benefit from Hyperliquid’s on-chain infrastructure.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens