The Contagion - Chung's Weekly Digest (7/4)

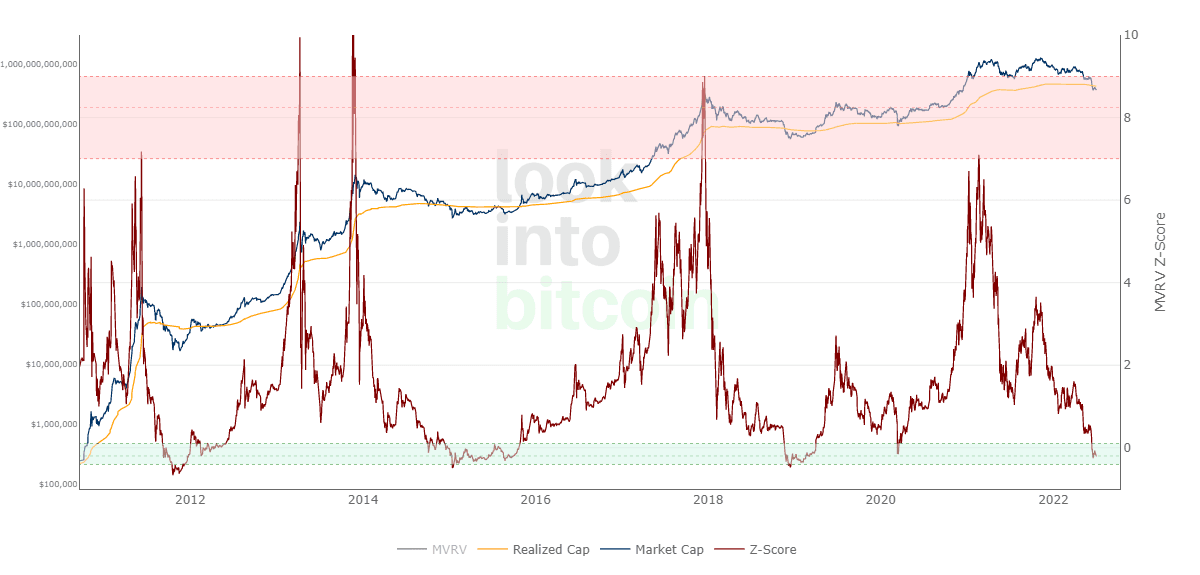

The crypto market survived the ICO bubble in 2017, but now it is facing the aftershocks from the Terra crash as it recalibrates itself to be more resilient.

BSCN

July 4, 2022

The Storm Is Not Over

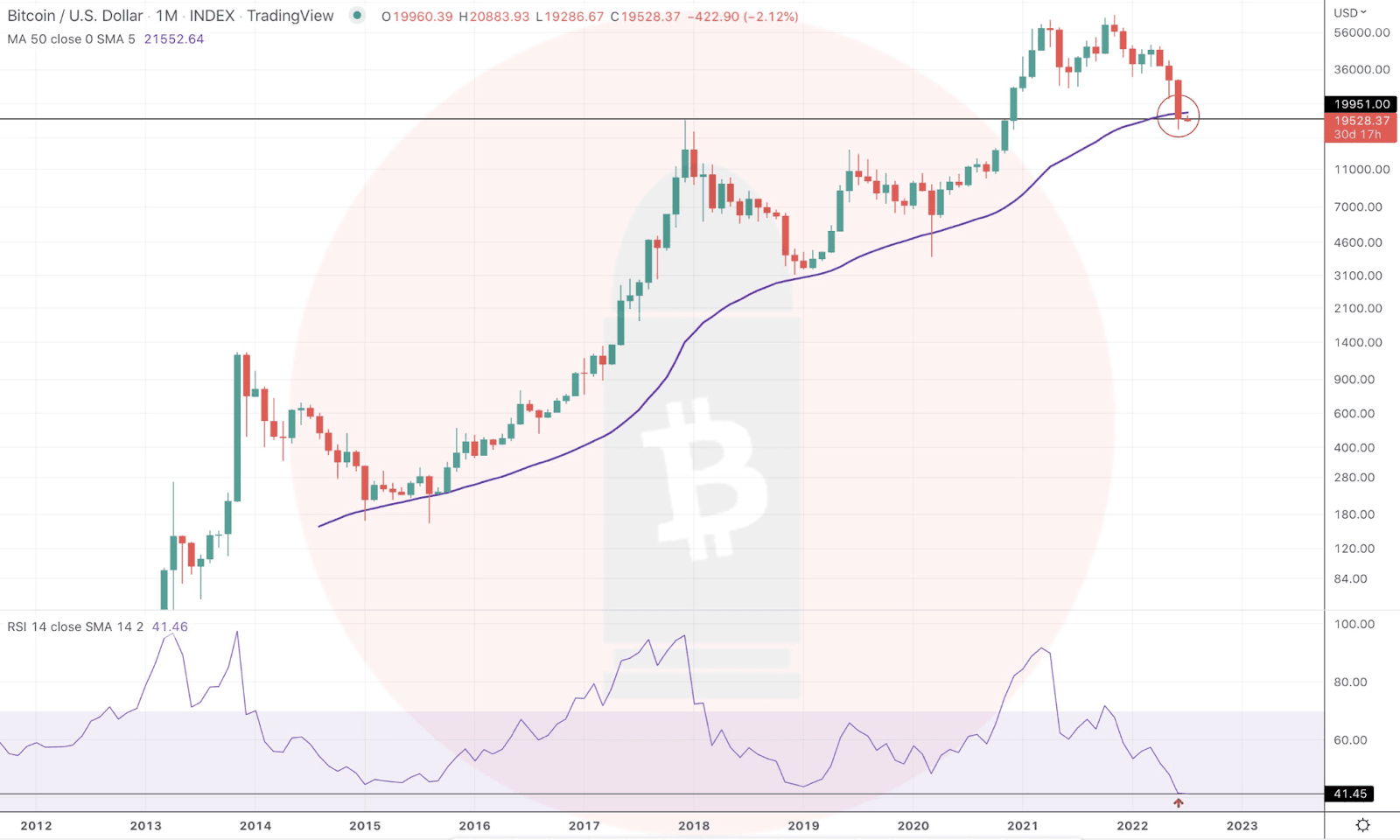

Bitcoin ($BTC) is finding it hard to stay above the $20k mark as some crypto platforms are fending off rumors of insolvency. This is a real concern as major crypto platforms are showing signs of distress, sparked by Terra’s collapse.

The latest dip in the crypto market has revealed questionable practices by some of the leading platforms in the space. This is the perfect storm for regulators to double down on their scrutiny of the crypto space.

However, this purge is essential to prevent the crypto bubble from further inflating. The fundamentals must be divorced from bad actors and questionable practices which are bad for the space.

Meanwhile, redistribution of Bitcoin is taking place.

One of the fundamental reasons why Bitcoin is less appealing today is largely attributed to uncertainty about its narrative as an ultimate store of value. Institutions and investors that bought into Bitcoin with its reserves to act as a hedge against inflation are now seeing massive devaluation in their portfolios. A highly volatile asset is not suitable as a store of value.

Weekly Recap

- Binance’s CEO says that the recent correction is presenting more opportunities.

- BNB Chain supports summer school at Zurich University.

- Voxels takes metaverse partying to a new level.

- ApeSwap proposes a plan to reduce emissions.

- Cronos launches Pioneer 11, a bridge to the Ethereum mainnet.

- Gary Gensler confirms that Bitcoin is not a security.

- Corite revolutionizes music with BNB Chain.

- The Bull Society launches NFT buy contest.

- Crypto.com NFT adds securities feature and collection activity filter.

- SafePal integrates support for Cronos.

- Moonlight rebrands to Bubble Maps.

Market Sentiment

The crypto market is now sitting at a market cap of $900 billion after reaching a high of $3 trillion at its peak. The market does not look promising as the damage caused by the recent Terra meltdown is still being revealed. Rumors are rife that more institutions will soon declare their losses as the liquidity crunch kicks in.

Major crypto platforms such as Coinbase, Houbi, Crypto.com and BlockFi are scaling down operations as part of cost-cutting measures. The recent market meltdown has forced crypto platforms to take conservative steps to ensure that operations can still run as the market heads into a bearish phase.

Crypto-based projects that hold their reserves in crypto assets suffered a massive devaluation in their balance sheet. Projects will soon be faced with operational issues as reserves will slowly be utilized. This will lead to a stagnation in growth and some projects will fail.

However, there is a glimmer of hope for this space. A working paper by the Bank for International Settlements (BIS) No. 1013, published in May 2022 by its Monetary and Economic Department, concluded by saying:

“While market activity has started from a relatively low base, the growth and trends over the past years underline the potential for cryptocurrencies and other forms of digital money (e.g. stablecoins and central bank digital currencies) to scale up quickly and become widely used. This, in turn, requires a proactive and forward-looking approach to regulating and overseeing such markets.”

Banking institutions are slowly waking up to the fact that digitalization of finance and Decentralized Finance (DeFi) can scale exponentially and are gaining adoption. Therefore, the same regulation and oversight must be applied to maintain financial stability and protect consumers.

Unlike previous cycles, cryptos are now making inroads into traditional industries and this may set the stage properly for the next cycle’s rally.

Coins to Watch

- The Sandbox ($SAND) - The metaverse theme is not a passing fad. There can be real-world utilities built in the metaverse on platforms such as The Sandbox.

- This platform has one of the most vibrant communities in its metaverse.

- It has a detailed roadmap and will likely be the leading decentralized metaverse platform.

- Decentraland ($MANA) - It is one of the oldest and most recognized metaverse platforms in the crypto space.

- Just like how Ethereum ($ETH) has the first-mover advantage as a smart contract platform, Decentraland has the first-mover advantage as a metaverse platform.

- Metaverse is an emerging trend and traditional brands are starting to build their presence in this space.

- $MANA has dropped considerably from its all-time high and will likely revisit its previous high when the market recovers.

- The metaverse theme is going to attract a lot of adoption and revolutionize how we interact with each other.

- BNB ($BNB) - $BNB is the utility token for the biggest global crypto platform. This is the utility that anchors the coin to a value that can be determined objectively.

- $BNB will be a bluechip investment and will likely be amongst the first few to recover once the market turns around.

- The BNB Chain continues to grow with funds specifically allocated for its community members. BNB Chain can benefit from Ethereum’s current inability to scale and this would increase the value of its native coin, $BNB.

Check out the Web3Wire Linktree to keep up with all relevant Web3 and Crypto!

Follow us on Twitter and Instagram!

Looking for a job in crypto? Check out the CryptoJobsNow!

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens