What Are NFTs? Non-Fungible Tokens Explained

Non-fungible tokens are unique digital assets recorded on blockchain. Learn how NFTs work, their uses, standards like ERC-721, and current market trends.

Crypto Rich

February 13, 2021

Table of Contents

Last revision: September 29, 2025

Non-fungible tokens (NFTs) are unique digital assets stored on a blockchain. Unlike cryptocurrencies, where one Bitcoin equals any other Bitcoin, each NFT is one-of-a-kind and cannot be swapped equally. Think of an NFT like a signed first-edition book. The book itself can be photocopied endlessly, but only one copy has the author's signature proving it's the original. NFTs work the same way for digital items.

Each NFT contains specific metadata that makes it distinct from any other token. Unlike fungible assets, such as Bitcoin or dollars, which hold identical value for each unit, NFTs derive their value from their uniqueness and verifiable scarcity.

The technology gained mainstream attention in 2021 but has since evolved beyond speculation. Today, NFTs serve practical applications across gaming, digital identity, licensing, and intellectual property management.

The NFT market experienced significant volatility between 2021 and 2023, with trading volumes reaching approximately $24.9 billion in 2021 (including wash trading and inflated volumes) before declining sharply during the crypto winter of 2022. Organic sales were estimated lower at $17-18.5 billion after accounting for market manipulation. In recent years, the technology has matured beyond profile pictures and art speculation. Today, it finds legitimate use in supply chain verification, event ticketing, and digital rights management.

How Do NFTs Work?

NFTs work through smart contracts on blockchain networks, most commonly Ethereum. When someone creates an NFT, they deploy a smart contract that contains the token's unique identifier, ownership history, and metadata. This metadata can include the asset's name, description, image link, and specific attributes that distinguish it from other tokens.

The ERC-721 standard, introduced in 2017, established the first framework for creating NFTs on Ethereum. Each token under this standard has a unique token ID and belongs to a single owner address at any given time. However, ERC-721 requires separate transactions for each token transfer, making bulk operations expensive on Ethereum's mainnet.

Unlike fungible tokens such as Bitcoin or USDT, where each unit equals any other unit, NFTs are indivisible and unique. You cannot split one NFT into smaller parts while maintaining its properties. The blockchain records every transaction involving the NFT, creating a permanent record of ownership that anyone can verify. This immutable record establishes provenance, which is particularly valuable for art, collectibles, and items where authenticity matters.

On-Chain vs Off-Chain Storage

Most NFTs store their actual content off-chain due to blockchain storage limitations. The smart contract typically contains a pointer to external storage, such as IPFS (InterPlanetary File System) or centralized servers, where the image, video, or other media reside. Owning an NFT token doesn't mean owning the underlying intellectual property or media file. Understanding this separation matters because the NFT itself is just a token with metadata, not the actual artwork or content.

Think of it like owning a certificate of authenticity for a painting. The certificate proves you own the original, but the certificate itself isn't the painting. If the museum storing your painting closes down, you will still have the certificate, but you will no longer be able to see your artwork.

This architecture creates potential permanence issues. If IPFS nodes stop hosting the content or centralized servers go offline, the NFT becomes a pointer to nothing. Several NFT projects have already experienced this, with images and metadata disappearing while the blockchain records remain.

Some projects have experimented with fully on-chain NFTs where all data lives directly on the blockchain. Fully on-chain NFTs cost more to create but eliminate dependency on external storage systems that could fail or disappear. Projects like Autoglyphs and Chain Runners store all visual data on-chain, making them permanent as long as the blockchain exists.

What Blockchain Networks Support NFTs?

Ethereum remains the dominant blockchain for NFT activity, hosting major marketplaces like OpenSea and established collections. However, several other networks have developed significant NFT ecosystems with different advantages.

Solana offers faster transaction speeds and lower fees than Ethereum, making it popular for gaming NFTs and high-volume trading. The network processes transactions in under a second. Costs typically stay below $0.01. Polygon, an Ethereum layer-2 solution, provides similar cost benefits while maintaining compatibility with Ethereum's infrastructure.

BNB Chain (formerly Binance Smart Chain) supports NFTs through its lower gas fees and faster block times. The network uses the BEP-721 and BEP-1155 standards, which mirror Ethereum's ERC standards. Bitcoin has entered the NFT space through Ordinals, a protocol that inscribes data directly onto individual satoshis. Unlike other blockchains that use smart contracts, Ordinals store the NFT data within Bitcoin transactions themselves using witness data, which is a section of Bitcoin transactions that holds additional information. This creates Bitcoin-native digital artifacts without needing separate smart contract functionality.

Flow blockchain, explicitly designed for NFTs and gaming, uses a multi-node architecture that separates consensus from computation. This design allows the network to scale without sharding or layer-2 solutions. NBA Top Shot, one of the most commercially successful NFT projects, operates on Flow.

What Are NFTs Used For?

NFTs have evolved from primarily speculative assets into functional tools across several industries. The technology provides verifiable ownership and transfer of digital items, enabling use cases that were impractical or impossible with traditional systems.

Gaming and Virtual Worlds

Gaming represents one of the most active NFT sectors.

Players own in-game items as NFTs that they can:

- Trade with other players across marketplaces

- Sell for cryptocurrency or fiat currency

- Use across different games that support the same standards

- Collect as permanent digital possessions

Games like Axie Infinity and The Sandbox built entire economies around NFT ownership, though many have struggled with sustainability and economic balance. Axie Infinity, which reached a $3 billion valuation in 2021, saw its economy collapse when player earnings couldn't sustain itself without new player money flowing in. The game's native token fell over 95% from its peak, leaving many players in developing countries who had invested significant money with losses. This pattern repeated across numerous play-to-earn projects, revealing the pyramid-like structure of economies that rely on continuous growth.

Major gaming companies have begun integrating NFTs more carefully, focusing on optional cosmetics and collectibles rather than pay-to-win mechanics. Ubisoft, Square Enix, and other publishers have experimented with NFT implementations, although the reception from traditional gaming communities remains mixed.

Digital Art and Collectibles

Digital artists use NFTs to sell original work and earn royalties on secondary sales. NFTs provide proof of authenticity and ownership for digital files that can be copied infinitely. While the 2021 art market boom was unsustainable, a smaller but stable market exists for digital art from established creators.

Collectibles have found consistent demand, particularly from brands with existing fan bases. Projects like Bored Ape Yacht Club demonstrated how NFTs could create exclusive communities with membership benefits, though many copycat projects failed. The concept of NFTs as membership tokens or access passes has proven more durable than pure speculation. Sports leagues, including the NBA, NFL, and UFC, have launched NFT collectible programs with varying success, with NBA Top Shot generating over $1 billion in sales during its peak.

Real-World Asset Tokenization

Companies are experimenting with NFTs to represent ownership of physical assets. Real estate deeds, luxury goods authentication, and supply chain tracking have all seen experimental implementations. A property in Florida sold for $653,000 as an NFT in February 2022, with the token representing legal ownership of the physical property.

Luxury brands use NFTs to combat counterfeiting by linking physical products to digital certificates. Nike acquired RTFKT Studios to develop NFT sneakers and digital fashion. However, adoption remains limited due to legal complexity and questions about the regulatory status of tokenized real-world assets.

Event Ticketing and Access Control

NFT tickets address issues such as counterfeiting and scalping, while giving event organizers more control over secondary markets.

Key advantages include:

- Prevention of counterfeit tickets through blockchain verification

- Programmable royalties that allow artists to earn from resales

- Dynamic tickets that change based on attendance history or membership status

- Permanent digital collectibles that preserve event memories

Coachella, UEFA, and other major event organizers have issued NFT tickets. The format enables tickets to become permanent collectibles, rather than disposable paper, potentially generating new revenue streams from commemorative digital items.

Identity and Credentials

Educational institutions and professional organizations are testing NFTs for diplomas and certifications. MIT has issued digital diplomas as blockchain certificates since 2017. Blockchain certificates prevent fraud and enable easy verification without requiring contact with the issuing institution.

Decentralized identity systems utilize NFTs to represent verified credentials that individuals own and control. Users could gain more privacy and control over their personal data compared to centralized identity systems, though widespread adoption faces significant technical and regulatory challenges. Soulbound tokens, a concept proposed by Vitalik Buterin in 2022, are non-transferable NFTs designed specifically for identity and credentials, preventing them from being sold or transferred after issuance.

What Are the Main NFT Standards?

Token standards define how NFTs function on specific blockchains. These standards ensure compatibility between different NFT projects, wallets, and marketplaces.

ERC-721

The ERC-721 standard defines the minimum interface a smart contract must implement to manage, own, and trade unique tokens on Ethereum. Proposed in 2017 and formally accepted in early 2018, it became the foundation for most NFT projects. Each token has a unique uint256 ID, and the contract tracks which address owns each ID.

The standard includes functions for transferring tokens, checking balances, and approving third parties to transfer tokens on an owner's behalf. However, ERC-721 requires separate transactions for each token transfer, making bulk operations expensive on Ethereum's mainnet.

ERC-1155

ERC-1155, developed by Enjin, allows a single contract to manage unlimited token types. A single contract can include fungible tokens, non-fungible tokens, and semi-fungible tokens. This design reduces deployment costs and enables more efficient batch transfers.

Gaming projects favor ERC-1155 because games typically involve a wide range of item types. A single contract can manage common items (fungible), rare items (non-fungible), and items that start as fungible but become unique through upgrades or customization.

Other Blockchain Standards

Solana uses a different technical approach than Ethereum, representing NFTs through its token program with specific metadata conventions. The Metaplex protocol provides the most common standard for Solana NFTs, defining how metadata should be structured and stored.

Bitcoin Ordinals don't use smart contracts. Instead, they inscribe data directly onto satoshis using witness data. Each satoshi can carry up to 4MB of arbitrary data, creating a fundamentally different NFT model without programmable functionality.

What Problems Do NFTs Face?

Despite maturing since 2021, NFTs continue to face several persistent challenges that limit their broader adoption and sustainability.

Environmental Concerns

Ethereum's transition to proof-of-stake in September 2022 reduced NFT energy consumption by approximately 99.95%. However, the earlier environmental criticism damaged NFT perception. Networks that still use proof-of-work, such as Bitcoin Ordinals, continue to face ecological scrutiny.

Layer-2 solutions and alternative blockchains offer lower energy consumption, but the association between NFTs and environmental harm persists in public perception, particularly among gaming communities that have resisted NFT integration.

Market Manipulation and Fraud

Beyond environmental concerns, the NFT market struggles with integrity issues. Wash trading, where users trade NFTs between wallets they control to inflate volume, remains common. Analysis by Chainalysis revealed that wash trading accounted for a significant portion of NFT trading volume on certain platforms. Fake collections impersonating legitimate projects continue appearing on marketplaces.

Copyright infringement represents another persistent issue. Artists have found their work minted as NFTs without permission, and marketplace platforms struggle to verify that NFT creators actually own rights to the content they're tokenizing.

Regulatory Uncertainty

The legal landscape adds another layer of complexity. Regulators have not yet definitively classified NFTs, and approaches vary significantly across different jurisdictions. Some may qualify as securities under certain conditions, particularly NFTs marketed as investments or tied to promised future development.

The European Union's Markets in Crypto-Assets (MiCA) regulation, implemented in 2024, treats certain NFTs as financial instruments if they're fractionalized or part of a larger series that resembles securities. The SEC in the United States has pursued enforcement actions against some NFT projects while leaving others alone, creating legal uncertainty for creators and platforms.

Tax treatment varies by jurisdiction and remains a complex issue. In the United States, NFTs are generally treated as property for tax purposes, meaning each sale or trade can trigger capital gains obligations. This creates significant record-keeping burdens for active traders.

What Does the Current NFT Market Look Like?

The current NFT market looks dramatically different from its 2021 peak. Trading volume has stabilized at lower, yet more sustainable, levels. Less speculation prevails, with a greater focus on utility and established brands.

Marketplace Landscape

OpenSea, which once processed billions in monthly volume, now handles substantially less, although it remains the largest NFT marketplace. Blur emerged as a competitor by offering zero fees and token incentives to traders. Magic Eden dominates Solana NFT trading, while specialized platforms cater to specific niches, such as gaming or music.

Blue-Chip Collections

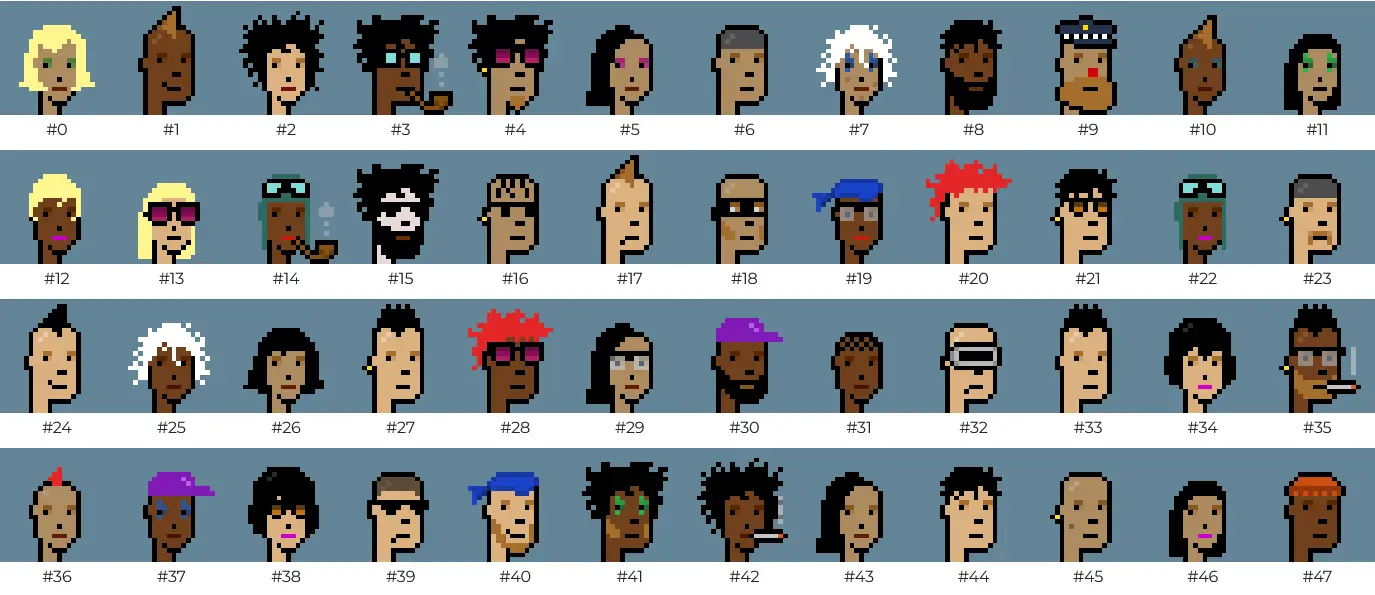

Blue-chip NFT collections like CryptoPunks and Bored Ape Yacht Club maintain value, though floor prices have dropped significantly from 2021-2022 highs. CryptoPunks, created in 2017, remain culturally significant as the earliest NFT project to achieve mainstream recognition. Historical significance and established communities now drive their value, rather than speculation about future gains.

The floor price for Bored Ape Yacht Club peaked above 144 ETH in April 2022 but has since stabilized at significantly lower levels. While this represents a substantial decline from peak values, prices remain far above the mint price of 0.08 ETH. The project continues operating with branded merchandise, events, and media partnerships.

Gaming and Enterprise Adoption

Gaming NFTs have shifted away from play-to-earn models that created unsustainable economies. Projects now emphasize player ownership and optional trading rather than making NFTs central to progression or success. Traditional gaming communities, concerned about monetization affecting game design, show less resistance to this approach.

Enterprise NFT adoption has grown quietly. Supply chain applications, internal licensing systems, and business-to-business implementations operate without public marketplaces or speculation. These use cases prioritize verification and transfer capabilities over collectibility or investment potential.

What Technical Developments Are Shaping NFTs?

Several technical improvements have addressed early NFT limitations while enabling new functionality. The market has also shifted toward emerging trends, including AI-generated content and Web3 social integration.

Dynamic and Evolving NFTs

Dynamic NFTs alter their properties in response to external data or on-chain events. An NFT character in a game might gain experience points, level up, or acquire new items, with these changes reflected in the token's metadata. Imagine a digital trading card of a basketball player that automatically updates its stats after each real game. Oracle networks like Chainlink enable NFTs to respond to real-world data feeds.

Some NFT projects use this for ongoing engagement. An NFT might change its appearance based on weather data, sports scores, or the holder's on-chain activity. This creates assets that remain interesting over time rather than static images.

Compressed NFTs

Solana introduced compressed NFTs in 2023, utilizing a structure known as state compression to significantly reduce costs. State compression works by storing minimal data on the blockchain itself, while keeping most information in a more compact format that can still be verified for authenticity. A compressed NFT costs approximately 0.000005 SOL to mint compared to roughly 0.01 SOL for a standard Solana NFT. This enables large-scale deployments like loyalty programs or free promotional items that were previously too expensive.

The compression technique uses Merkle trees to store minimal data on-chain while maintaining security and verifiability. This structure allows millions of NFTs to exist for the storage cost of a few hundred standard NFTs.

Cross-Chain Standards

Several projects are developing standards for moving NFTs between different blockchains. Moving an NFT from one blockchain to another requires special bridge solutions that essentially lock the original NFT and create a wrapped version on the destination chain.

The Inter-Blockchain Communication protocol enables NFT transfers between certain compatible chains. Bridge solutions allow moving NFTs between Ethereum and layer-2 networks, though bridges have security risks as demonstrated by several high-profile hacks where hundreds of millions of dollars were stolen.

True interoperability remains limited because different blockchains use incompatible technical standards. An NFT created on Ethereum cannot directly function on Solana without a bridging mechanism that creates a representation of the original token.

Programmable Royalties

ERC-2981 standardizes royalty payments, allowing creators to specify a percentage they'll receive from secondary sales. However, this remains optional, and some marketplaces have made royalties optional or eliminated them entirely to compete on fees.

This has created tension between creators who depend on royalty income and marketplaces trying to attract volume with lower costs. Some projects now enforce royalties at the smart contract level, requiring sales to go through approved contracts that honor royalty terms.

AI-Generated NFTs and Authenticity

The rise of AI image generation tools has created new use cases and challenges for NFTs. Artists use NFTs to establish the authorship of AI-generated works, tracking which prompts and models were used to create specific outputs. Some platforms mint NFTs that include the AI generation parameters as metadata, creating verifiable ownership chains similar to the provenance tracking described earlier.

However, AI-generated NFTs also complicate questions of copyright and authenticity. If an AI creates an image, who owns it—the person who wrote the prompt, the AI company, or no one? NFTs don't solve these legal questions but provide a technical layer for tracking creation and ownership chains.

Web3 Social Integration

NFTs are increasingly integrated into decentralized social platforms where they serve as profile pictures, access badges, and reputation signals. Platforms like Farcaster and Lens Protocol use NFTs to represent social graphs and content ownership. Your social connections, posts, and reputation become portable assets you control rather than platform-owned data.

This integration positions NFTs as infrastructure for user-owned social networks rather than standalone collectibles. The shift represents a move toward utility-focused implementations where NFTs enable functionality instead of existing purely as speculative assets.

Conclusion

Non-fungible tokens provide verifiable, unique digital assets through smart contracts on blockchain networks. The technology utilizes standards such as ERC-721 and ERC-1155 on Ethereum or equivalent frameworks on other chains to manage ownership and transfers.

After the 2021-2022 speculative bubble, NFTs have found practical applications in gaming, digital identity, ticketing, and intellectual property management. The market has contracted from peak volumes but maintains activity in sectors focused on utility rather than speculation. Technical improvements like compressed NFTs and dynamic metadata have expanded capabilities while reducing costs.

As artificial intelligence integrates deeper into creative work and digital experiences, NFTs may prove crucial for establishing authorship and authenticity. The intersection of NFTs with AI, virtual reality, and decentralized social networks suggests the technology's most significant applications may still lie ahead.

Sources

- Ethereum Improvement Proposals (EIPs) - ERC-721 and ERC-1155 standards documentation, Ethereum Foundation.

- Chainalysis, 2024 annual report - NFT market activity and wash trading analysis.

- Metaplex Documentation - Solana NFT standards and implementation specifications.

- DappRadar NFT Market Reports - Historical trading volume data and market analysis, 2021-2025.

- OpenSea Developer Documentation - NFT marketplace APIs and metadata standards.

- Solana State Compression Documentation - Technical specification for compressed NFT implementation.

Read Next...

Frequently Asked Questions

Can NFTs be copied or screenshot?

The digital file can be copied, but the blockchain ownership record cannot. Owning an NFT means holding the verified original token on the blockchain, not exclusive access to the image or file itself.

Do I own the copyright if I buy an NFT?

No. Purchasing an NFT typically grants ownership of the token only, not the underlying copyright. The creator retains intellectual property rights unless the sale explicitly includes IP transfer in its terms.

What happens to my NFT if the marketplace shuts down?

Your NFT ownership remains recorded on the blockchain regardless of marketplace status. You can view tokens through any compatible wallet. However, if metadata and images were stored on marketplace servers, that content may become inaccessible.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens