Beefy Finance Deepdive: A DeFi Ecosystem

Discover how Beefy Finance evolved from a BNB Chain yield optimizer in 2020 to a multichain DeFi platform in 2025, featuring its Ethereum migration and recent high-APY vaults.

Crypto Rich

February 25, 2025

Table of Contents

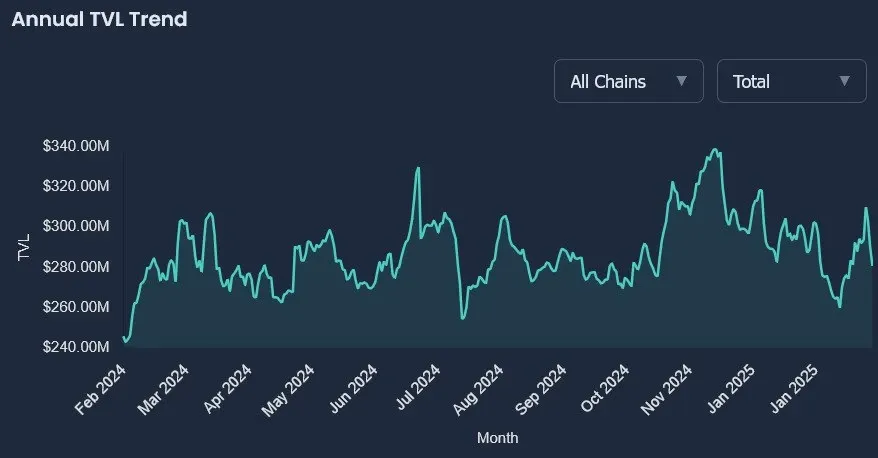

Beefy Finance launched on Binance Smart Chain on October 8, 2020, offering an innovative way to auto-compound yields from PancakeSwap pools. With its native $BIFI token supply capped at 80,000, Beefy quickly gained popularity among yield farmers. After Multichain's collapse in 2023, Beefy migrated to Ethereum, adapting its governance and reward systems. Now in 2025, the platform has expanded to operate across 22 different chains, with recent developments including the addition of memecoin vaults on BNB Chain and an ambitious SafeBoost campaign on Gnosis.

BNB Chain and the Birth of Beefy Finance

Beefy Finance made its debut during a time when high Ethereum gas fees were forcing yield farmers to look for alternatives. The platform introduced specialized vaults that automatically compounded rewards from PancakeSwap liquidity pools, significantly improving efficiency for users.

The launch of Beefy's native $BIFI token was a key element of its success. With a hard cap of 80,000 tokens, the supply was distributed with 72,000 in circulation and 8,000 locked for the team until July 2022. This limited supply created scarcity while the token's utility provided real value - stakers received a share of profits generated by the platform's vaults and gained voting rights through the Beefy DAO.

In March 2021, Beefy received a significant boost when $BIFI was featured in a PancakeSwap Syrup Pool, expanding its user base and visibility in the DeFi space. The platform's popularity grew thanks to several advantages:

- The low transaction costs on BNB Chain allowed for frequent compounding, maximizing yields

- Beefy's no-lockup policy gave users flexibility with their funds

- The protocol's transparent approach to risk management built trust with the community

During this early period, Beefy established itself as a leading yield optimizer on BNB Chain, setting the foundation for its future expansion across multiple networks.

The Ethereum Migration After Multichain's Collapse

As Beefy Finance grew, it began expanding beyond BNB Chain to other networks using Multichain as a bridge. This cross-chain strategy initially worked well.

However, the collapse of Multichain in 2023 created a crisis that forced Beefy to make a strategic pivot. By October 24, 2023, the platform completed the migration of $BIFI to Ethereum as an ERC-20 token, maintaining its 80,000 token supply cap. This move prioritized the security and stability of Ethereum over the lower fees of BNB Chain.

The migration introduced several important changes to Beefy's ecosystem:

- The Universal Governance Pool contract (UGP) owned by the Beefy DAO became the new mechanism for controlling several aspects of the protocol

- Stakers now earned rewards in $ETH rather than in $BIFI

- MooBIFI was introduced as a cross-chain token for Ethereum-staked $BIFI

This migration represented more than just a technical change - it signified Beefy's evolution into a new multichain platform with Ethereum as its new home base. Throughout this challenging transition, Beefy's DAO, powered by the 80,000 $BIFI tokens and their holders, guided the protocol toward stability across multiple blockchain environments.

2025's Strategic Initiatives and Growth

In 2025, Beefy Finance continues demonstrating its ability to adapt and innovate in the DeFi space. The platform recently revitalized its presence on BNB Chain by adding popular high-yield BNB Chain memecoin vaults. Popular BNB Chain memecoin launchpad Fourmeme tokens, like Broccoli, Siren, and TST (Test) now have their own BNB Chain vaults and pools on Beefy.

2025 also saw the beginning of the SafeBoost campaign, a major six-month campaign on the Gnosis chain in partnership with Safe and Karpatkey. This initiative offers substantial $SAFE token incentives to attract liquidity to the Gnosis chain.

Beefy's recent developments showcased the platform's continued momentum with:

- The introduction of Berachain's Zap functionality for direct token-to-vault swaps

- 28 active Boost campaigns spread across its 22-chain ecosystem

- 20+ new vault strategies

Beefy's Position in the DeFi Ecosystem

From its origins as a yield optimizer on BNB Chain, Beefy Finance has grown into a significant DeFi platform operating across 22 blockchains, demonstrating remarkable breadth in the DeFi ecosystem. Today, Ethereum serves as Beefy's primary hub, with the 80,000 $BIFI tokens powering a DAO that distributes profits and conducts voting through the DAO.

While Yearn Finance remains a notable competitor in the yield optimization space, Beefy's multichain approach provides a distinct advantage in reaching users across different networks. The platform's vaults continue to attract users despite the inherent risks in DeFi, with Beefy maintaining its commitment to security and transparency.

Key factors in Beefy's current market position include:

- Its extensive presence across 22 blockchains allows for unmatched flexibility in responding to market conditions

- The limited supply of 80,000 $BIFI tokens creates value for holders

- The UGP and MooBIFI system effectively distributes rewards to stakeholders

- Continued innovation with new vaults and features keeps the platform competitive

The recent SafeBoost campaign and the implementation of Berachain's Zap functionality indicate Beefy's ongoing commitment to growth across multiple chains.

Conclusion

Since its 2020 launch on BNB Chain, Beefy Finance has successfully navigated the evolving DeFi landscape by adapting to changing market conditions and user needs. The 2023 Multichain disruption catalyzed Beefy's migration to Ethereum, where it rebuilt its core systems while preserving its 80,000 token supply and community governance.

In 2025, Beefy continues to show its resilience and innovation through the SafeBoost campaign on Gnosis. Operating across 22 blockchains with Ethereum as its base, Beefy has established itself as one of the most extensive and mature yield optimization platforms in the DeFi space.

Beefy's journey demonstrates the importance of adaptability in DeFi. From its beginnings auto-compounding PancakeSwap yields to its current position as a yield optimizer spanning 22 blockchains, Beefy has consistently evolved to meet the needs of DeFi users across the entire ecosystem. As the ecosystem continues to develop, Beefy's combination of auto-compounding strategies, multichain presence, and community governance positions it for continued relevance in the yield optimization sector. Through all the changes in the DeFi landscape, Beefy Finance remains true to its mascot – a happy cow continuously grazing on yields across the blockchain pastures.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens