Deepdive

(Advertisement)

BabyDoge: Complete Guide to the Multi-Chain Memecoin

Complete BabyDoge guide: zero-fee transactions, multi-chain, MissionPawsible gaming $MISSION, real estate integration, and $1.4M+ donated to animal charities.

Crypto Rich

May 12, 2025

(Advertisement)

Table of Contents

Revised as of August 27, 2025

BSC News has followed BabyDoge since its earliest days on BNB Chain in 2021 — watching it evolve from a Dogecoin spinoff into today's broad multi-chain ecosystem.

BabyDoge Coin ($BABYDOGE) has achieved what most memecoins struggle to attain: genuine utility that extends beyond mere speculation. The project combines zero-fee transactions with gaming, payments, and real estate applications while maintaining a charitable mission that has donated over $1.4 million to animal welfare organizations.

What started as another Dogecoin spinoff in June 2021 has become a multi-chain ecosystem that challenges assumptions about memecoin limitations. With over 1.9 million holders across six blockchain networks, BabyDoge demonstrates how community-driven development can create lasting value in an industry notorious for pump-and-dump schemes.

Why Should Crypto Users Care About BabyDoge?

The memecoin space is littered with failed projects that promised utility but delivered only hype. BabyDoge took a different path. Instead of chasing trends, the anonymous development team built infrastructure that actually works.

Consider the numbers: 50+ exchange listings, including Kraken perpetual futures. A gaming platform with 20 million registered users. Payment integrations that enable people to spend BABYDOGE at real-world businesses. A real estate platform that tokenizes physical properties. These aren't roadmap promises—they're operational features generating real usage.

The project gained mainstream attention when Elon Musk tweeted about it in 2021, but sustained growth came from community building rather than celebrity endorsements. The "BabyDoge Army" spans 2.7 million X followers, 1.5+ million Telegram members, and 592,000 Instagram followers—engagement levels that rival established cryptocurrencies with much larger market capitalizations.

Key Features

BabyDoge operates across multiple blockchain networks through its official bridge:

- Primary Network: BNB Chain (BEP-20 token)

- Cross-Chain Support: Base, TON, and Solana

- Transaction Fees: Zero fees for buying, selling, and transferring

- Supply Model: deflationary with regular token burns

- Mission Focus: Animal welfare and charity initiatives

The multi-chain approach prioritizes fast, low-fee networks while maintaining compatibility with major blockchain ecosystems. BabyDoge can reach users wherever they prefer to transact.

Exchange Listings

BabyDoge maintains strong liquidity across 34 centralized exchanges, including KuCoin, OKX, Bybit, and Gate.io. The project reached a significant milestone with Kraken's listing of perpetual futures, which provides leveraged trading access and institutional credibility.

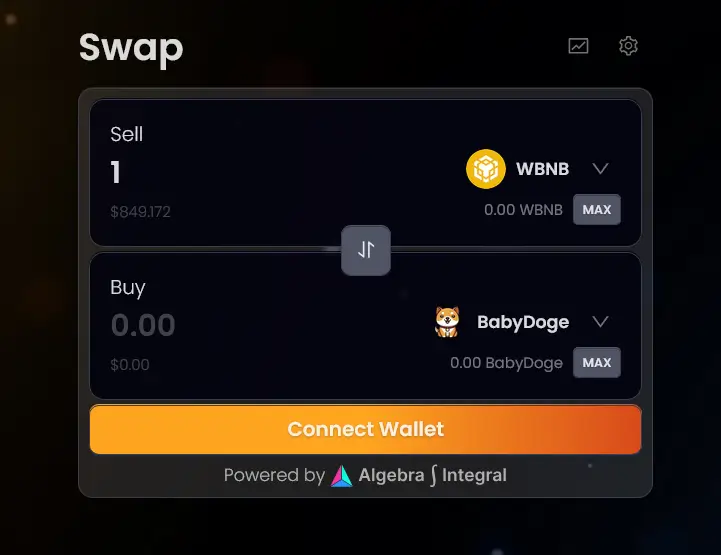

On the decentralized side, BabyDoge trades on PancakeSwap, Uniswap, and BiSwap. However, the project's native BabyDogeSwap serves as the project's primary DEX. Market capitalization has consistently exceeded $200 million, reflecting sustained investor interest beyond typical memecoin cycles.

How Do BabyDoge's Economics Create Value?

Most memecoins either inflate indefinitely or maintain a static supply. BabyDoge chose deflation—and the results speak volumes. Starting with 420 quadrillion tokens, over half have been permanently destroyed through systematic burn campaigns.

This isn't just supply reduction for its own sake. Each burn event signals ecosystem activity: transactions processed, community engagement, and platform usage. When 1 quadrillion tokens, worth $2.6 million, are burned in a single event, it demonstrates genuine economic momentum rather than artificial scarcity.

Supply Reduction Mechanics

Current tokenomics show the deflation strategy's impact:

- Initial Supply: 420 quadrillion tokens

- Tokens Burned: Over 217 quadrillion (51% of initial supply)

- Current Total Supply: 202.61 quadrillion tokens

- Circulating Supply: Approximately 168.22 quadrillion tokens

Major burn events include the March 2023 destruction of 1 quadrillion tokens, valued at $2.6 million, and the April 2025 burn of 11.14 trillion tokens, worth $14,919.88. Community-driven initiatives, such as "1 like = $1 BABYDOGE burned" campaigns and the “burn Portal,” create ongoing supply pressure.

Fee Structure Evolution

The project initially charged a 10% transaction fee—half for holder rewards and half for liquidity and burns. But in May 2024, the community voted to eliminate all fees through DAO governance. This decision prioritized accessibility over passive income, signaling a shift toward utility-driven growth rather than speculative holding rewards.

Zero fees matter in practical terms. Users can transfer any amount without transaction costs. Merchants can accept payments without fee calculations. Gaming platforms can process micro-transactions without friction. Positioning BABYDOGE for real-world usage rather than just trading speculation.

Burn Mechanisms

Token burns continue through multiple channels. Manual events see large-scale burns announced by the team. Automated systems are built into ecosystem applications. The community can participate through a burn portal on BabyDogeSwap. Significant portions get sent to BNB Chain's burn address.

The deflationary approach contrasts sharply with Dogecoin's model, which maintains an inflationary supply; BabyDoge's supply only decreases—potentially supporting price appreciation through scarcity. This contrasts with Bitcoin's capped supply model and Dogecoin's unlimited inflation.

What Makes BabyDoge's Ecosystem Actually Work?

Building utility in crypto is more complicated than most projects realize. Users need reasons to engage beyond price speculation. BabyDoge solved this through diversification across multiple high-engagement verticals.

Trading Infrastructure

BabyDogeSwap exemplifies this approach. Rather than relying on third-party DEXs, the project built its own exchange on the BNB Chain network. Users can trade tokens with zero BABYDOGE transaction costs, participate in yield farming, stake for ecosystem rewards, and directly contribute to token burns through an integrated portal.

The technical development continues to advance. V2 and V4 pool routing systems are currently in quality assurance, with design improvements based on community feedback. Major aggregator integrations are in progress. The user interface has recently undergone a facelift, and with the integration of the Algebra DEX engine, trading becomes even smoother.

Gaming Platform

Gaming serves as another strategic pillar. The MissionPawsible Telegram mini-app game (recently rebranded from PAWS) has attracted over 15 million players in its beta phase, with 1.5 million joining within 24 hours of launch. This viral adoption demonstrates genuine engagement rather than paid user acquisition.

The project's Token Generation Event (TGE) for the $MISSION token — on August 29, 2025, with KuCoin confirmed as the first major exchange to list it. Airdrop rewards for eligible players were determined through snapshots completed on August 20 and 25. MissionPawsible is a mobile GameFi platform integrated into Telegram, offering city-builder gameplay with Web3 economy elements, powered by $MISSION tokens.

Memecoin Creation Platform

Puppy.fun launched in 2024 as BabyDoge's answer to memecoin creation platforms, BNB Chain's version of Solana's Pump.fun. The platform makes launching memecoins simple—no coding skills or whitepapers required.

Launch Mechanics

The creation process streamlines token deployment through user-friendly interfaces:

- Simple Setup: Users input basic details like token name, symbol, and image

- Liquidity Protection: Automatic locking on DEXs like BabyDogeSwap and PancakeSwap prevents rug pulls

- Creator Rewards: Token creators earn "Gems" as incentive rewards

- Migration System: Automatic DEX listing when tokens reach 22 BNB liquidity (~$60,000 market cap)

- Community Integration: New tokens gain instant access to the established BabyDoge ecosystem support

Ecosystem Impact

The integration with BabyDoge's existing ecosystem gives new tokens instant access to established community support. Additional launchpad features include GASPUMP, which provides gas-free solutions with community events and airdrops. Recent activity includes BabyDoge adding liquidity to BabyBroccoli, a Puppy.fun project, using 95 million tokens and $75,000 in BNB.

Can Memecoins Actually Facilitate Real Commerce?

The gap between crypto promises and real-world adoption remains vast for most projects. BabyDoge addresses this through a comprehensive payment infrastructure that bypasses common friction points.

Payment Processing Integration

Multiple payment processors enable direct BABYDOGE spending without conversion hassles:

- NOWPayments: Business payment acceptance and donation processing

- FCF Pay: Virtual Visa/Mastercard prepaid cards funded with BABYDOGE

- UQuid: Bill payments and gift card purchases

- CoinPayments: E-commerce integration for Shopify, WooCommerce, and Magento

- Onramper: Fiat on-ramp services for easy token acquisition

The real innovation lies in removing conversion friction. Traditional crypto payments require users to: hold crypto → convert to stablecoin → convert to fiat → spend. BabyDoge's integrations enable: hold BABYDOGE → spend directly. This elimination of intermediate steps addresses one of cryptocurrency's biggest adoption barriers.

Real Estate Tokenization

The real estate platform pushes boundaries further. BabyDoge Properties allows users to invest in tokenized physical properties, making it the first memecoin to bridge digital assets with real-world assets (RWA).

The RWA integration is significant because it provides tangible asset backing for digital tokens. Instead of purely speculative value, BABYDOGE holders can participate in real estate appreciation and rental income through tokenized ownership structures.

Why Does Charitable Impact Matter for Cryptocurrency Projects?

Most crypto projects claim social responsibility but deliver little beyond marketing campaigns. BabyDoge's charitable work shows a genuine impact that creates emotional investment beyond financial speculation.

Over $1.4 million donated to animal rescue organizations isn't just philanthropy—it's community building through shared values. Donations to The Humane Society of the United States, North Shore Animal League America, and Best Friends Animal Society (which received $100,000 directly) establish credibility with mainstream charitable organizations.

The world record for the largest pet food donation within 24 hours—81,000 pounds to animal welfare causes—demonstrates coordination capabilities that extend beyond digital transactions. This achievement is verified by Guinness World Records. Community members vote on charitable recipients through DAO governance, ensuring democratic participation rather than top-down allocation decisions.

This approach creates resilience during market downturns. When holders connect emotionally with the project's mission, they're more likely to maintain positions through volatility. It transforms investment psychology from pure speculation to value-based participation.

How Does Multi-Chain Strategy Address Crypto's Fragmentation Problem?

Blockchain maximalists often argue for single-network dominance, but users demand flexibility. BabyDoge's multi-chain approach acknowledges the fragmented reality of crypto while maintaining operational coherence.

Network Infrastructure

Official bridges connect six major blockchain ecosystems, each serving specific user needs:

- BNB Chain: Primary network with full ecosystem support

- Base: Coinbase ecosystem integration and layer-2 scaling benefits

- TON: Direct Telegram connectivity for social features

- Solana: Ultra-fast blockchain for DeFi, NFTs, and Gaming

This isn't random expansion—each network addresses specific user preferences and use cases while maintaining unified functionality across chains.

Security Framework

Security remains paramount through professional Certik audits and transparent development practices. Multi-year operational history without major security incidents builds institutional confidence while DAO governance ensures community input on critical decisions.

The technical infrastructure supports this complexity through coordinated development across chains. Cross-chain bridges maintain liquidity while preserving security standards. Users can choose their preferred network without sacrificing ecosystem access or functionality.

What Separates Genuine Community from Social Media Metrics?

Follower counts mean little without engagement quality. BabyDoge's community metrics reveal genuine participation, rather than inflated numbers resulting from bot networks or paid promotions.

Social Media Presence

The "BabyDoge Army" demonstrates authentic engagement across major platforms:

- X (Twitter): 2.7 million followers participating in governance discussions

- Telegram: 1.5 million members coordinating burn campaigns and charitable initiatives

- Instagram: 592,000 followers engaging with visual content and updates

- Token Holders: Over 1.9 million addresses with actual financial commitment

These holders participate in DAO governance votes that affect project direction, including the significant decision to eliminate transaction fees entirely.

Community Activities

Community engagement extends beyond typical crypto participation through multiple interactive channels:

- DAO Governance: Voting on fee structures and development priorities that shape project direction

- Burn Campaigns: Direct community participation in supply reduction through coordinated events

- MissionPawsible Gaming: Interactive Telegram mini-app with over 15 million players and the upcoming $MISSION token integration

- Charitable Selection: Democratic philanthropy through blockchain governance for animal welfare recipients

- Social Challenges: Viral marketing initiatives that drive organic growth

This engagement level creates network effects that sustain projects through market cycles. When community members have multiple touchpoints—such as gaming, governance, charity, and trading—they're less likely to abandon the ecosystem during price downturns.

Conclusion

BabyDoge's evolution from Dogecoin derivative to multi-faceted ecosystem demonstrates that memecoins can build lasting value through practical utility rather than pure speculation.

The metrics tell the story: 1.9 million token holders, 20 million registered players (per BabyDoge stats), $1.4 million in charitable donations, and institutional recognition through Kraken's listing of perpetual futures. These achievements stem from prioritizing working applications over roadmap promises and organic community building over paid marketing.

What distinguishes BabyDoge is its rejection of common industry patterns. Zero-fee transactions, gaming engagement, charitable impact, and real-world asset integration create multiple value drivers that extend beyond token price movements.

For an industry often criticized for empty promises, BabyDoge offers a template for sustainable memecoin development that delivers measurable utility and genuine community impact.

Visit the official BabyDoge website and follow @BabyDogeCoin on X for the latest updates.

Sources:

- BabyDoge Official Website

- BabyDogeSwap Documentation and Features

- Certik Security Audit Reports

- NOWPayments Integration Documentation

- Guinness World Records Pet Food Donation

- KuCoin MISSION Token Listing Announcement

- @BabyDogeCoin Official Updates

- @PAWSBabyDoge Official Updates

- BscScan holder count

- CoinMarketCap market data

Read Next...

Frequently Asked Questions

Can I use BabyDoge for everyday purchases?

Yes, BabyDoge integrates with NOWPayments, FCF Pay, and UQuid for gift cards, bill payments, and business transactions. Virtual Visa/Mastercard debit cards are also available.

Is BabyDoge available on multiple blockchains?

BabyDoge operates primarily on BNB Chain but maintains official bridges to Solana, Base, and TON networks.

What charitable work does BabyDoge support?

BabyDoge has donated over $1.4 million to animal rescue organizations, including The Humane Society, North Shore Animal League America, and Best Friends Animal Society. Community members vote on charitable recipients through DAO governance.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

(Advertisement)

Latest News

(Advertisement)

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens