What is BNB Chain? The Ultimate L1

Discover BNB Chain, a leading Layer one blockchain platform offering fast transactions, low fees, and EVM compatibility. Learn about its origins, technology, and growing ecosystem in this comprehensive guide.

Crypto Rich

February 13, 2025

Table of Contents

BNB Chain has emerged as a formidable Layer-one solution, offering a robust alternative to Ethereum. This comprehensive guide explores how BNB Chain has transformed from its humble beginnings into a thriving ecosystem that powers countless decentralized applications, smart contracts, and innovative blockchain solutions.

Origins and Founding

BNB Chain's journey began in September 2020 under the name Binance Smart Chain (BSC), launched by the cryptocurrency exchange giant Binance. The platform underwent a strategic rebranding to BNB Chain in February 2022, reflecting its evolution beyond its initial scope and cementing its position as an independent blockchain ecosystem.

The founding vision was clear: create a high-performance blockchain platform that maintains Ethereum Virtual Machine (EVM) compatibility while addressing the scalability and cost issues that had plagued other networks. This approach proved particularly prescient during the 2021 crypto bull run, when Ethereum's high gas fees made smaller transactions prohibitively expensive.

How Does BNB Chain Work?

At its core, BNB Chain employs an innovative Proof-of-Staked-Authority (PoSA) consensus mechanism, representing a sophisticated hybrid between traditional Proof of Stake and Proof of Authority systems. This architectural choice enables remarkably fast block times and maintains consistently low gas fees, two critical factors in its widespread adoption.

The ecosystem comprises three fundamental components that work in harmony:

- BNB Smart Chain (BSC)

- Serves as the primary smart contract platform.

- Maintains full EVM compatibility.

- Processes transactions with 3-second block times.

- Supports the development of decentralized applications.

- opBNB

- Functions as a Layer-2 scaling solution.

- Dramatically increases transaction throughput.

- Further reduces transaction costs.

- Maintains security through the main chain.

- BNB Greenfield

- Provides decentralized storage infrastructure.

- Enables sophisticated data management solutions

- Integrates with traditional Web2 applications.

- Supports new data ownership models.

The BNB Token: Powering the Ecosystem

The BNB token stands at the heart of the BNB Chain ecosystem, originally launched as an ERC-20 token during Binance's ICO in 2017. Its migration to its native chain in 2019 marked a significant milestone in the platform's development. Today, BNB serves as the native gas token for all operations on the network, enables holders to participate in governance decisions, and powers various applications across DeFi, GameFi, and other sectors. Additionally, token holders can participate in network security and earn rewards through staking mechanisms.

BNB Tokenomics: A Model of Scarcity

The tokenomics of BNB represent a carefully designed economic model focused on creating sustainable value. With an initial supply of 200 million tokens, the implementation of regular burning mechanisms has consistently reduced the available supply, currently standing at 142.47 million BNB. The token-burn mechanism stops when there are 100 Million tokens left.

The burning mechanism operates through two distinct channels. First, Binance conducts regular quarterly token burns based on trading volume. Second, the BNB Chain network features an auto-burn mechanism that permanently removes tokens from circulation. Additionally, various projects and individuals have contributed to the token's scarcity by sending over 7 Million BNB to the chain's burn address (0x000000000000000000000000000000000000dEaD).

Recent Developments and Ecosystem Growth

BNB Chain's recent evolution has focused on expanding its capabilities and use cases. The integration of opBNB has significantly enhanced the network's scalability, while the introduction of the Memecoin Solution has established a comprehensive platform for launching and sustaining memecoin projects within the ecosystem.

The ecosystem has experienced remarkable growth across multiple sectors. In the DeFi space, numerous protocols have emerged that offer sophisticated financial services, from lending and borrowing to yield farming and liquidity provision. The GameFi sector has flourished with innovative blockchain-based gaming projects that leverage the network's high performance and low fees. Additionally, the platform has embraced cutting-edge technology by facilitating artificial intelligence applications on the blockchain, while also supporting a vibrant memecoin community.

The Memecoin Revolution on BNB Chain

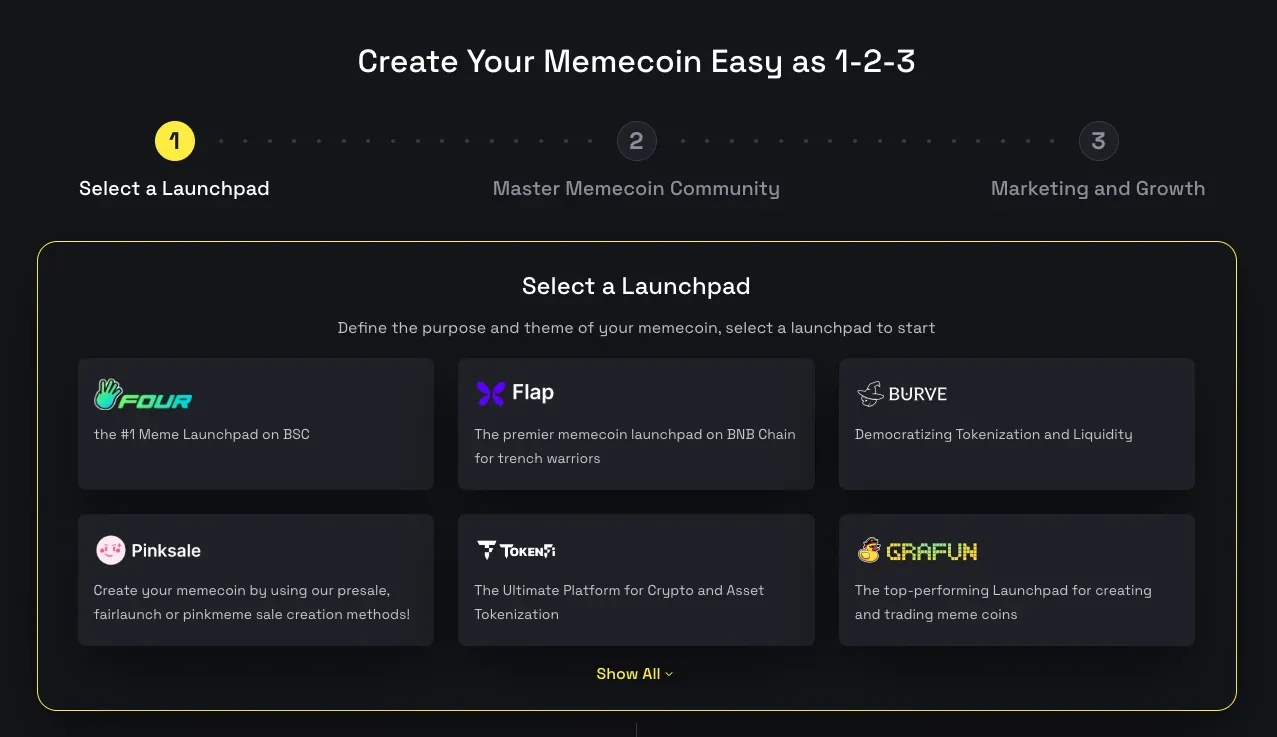

BNB Chain's Memecoin Solution represents a significant advancement in the memecoin space, offering a comprehensive platform that goes beyond simple token creation. Unlike platforms such as pump.fun on Solana, which focuses primarily on rapid deployment and instant trading, BNB Chain's solution provides a complete ecosystem for sustainable project development. The platform includes advanced features such as tokenomics configuration, audit support, liquidity management, and robust community engagement tools.

What sets the Memecoin Solution apart is its emphasis on long-term project viability. While pump.fun streamlines token creation for quick launches and trading events, BNB Chain's platform aggregates various essential services needed for sustained success. This includes tools for marketing, community building, and ongoing project support, making it an ideal choice for projects aiming to establish a lasting presence in the cryptocurrency space.

Notable success stories like BabyDoge Coin and Floki demonstrate the potential for memecoin success on the platform. These projects have not only attracted substantial trading volume but have also built engaged communities that contribute to the overall vibrancy of the BNB Chain ecosystem.

Conclusion

BNB Chain has successfully positioned itself as a leading Layer one blockchain, offering a compelling alternative to Ethereum while maintaining compatibility with its vast ecosystem. Through continuous innovation, strategic partnerships, and community-driven development, BNB Chain has evolved far beyond its origins as a simple smart contract platform.

As the blockchain industry continues to mature, BNB Chain's commitment to scalability, efficiency, and user-friendly development tools suggests a bright future. Whether for developers building sophisticated DeFi applications or communities launching the next viral memecoin, BNB Chain provides the infrastructure and support needed to turn blockchain innovations into reality.

Recent BNB Chain Coverage:

- BNB Chain Recent Updates: New Products, Governance Changes, & Ecosystem Growth

- What is the BNB Chain Fermi Hard Fork?

- YZi Labs Launches $1B Builder Fund to Support BNB Ecosystem Founders

- BNB Chain Turns Five: Major Upgrades, Milestones, and Market Growth

- BNB Chain Integrates Chainlink Data Standard to Bring U.S. Economic Data Onchain

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events